Pharmaceutical Contract Manufacturing, R&D Gets Boost with New Mega Facility in Maharashtra

Global pharmaceutical industry supplier ACG recently announced its plans to invest INR 6 billion (US$80.56 million) to build Asia’s largest capsule manufacturing unit in India (near Aurangabad in the western state of Maharashtra). This facility will augment India’s industrial capacity to provide high quality, safe, and affordable medicines and nutraceuticals globally. ACG was founded in Mumbai in 1961 and is now present worldwide, providing integrated solutions for the pharmaceutical and nutraceutical industries.

Setting up Asia’s largest capsule manufacturing factory and research center

With presence in over 138 countries, ACG is the world’s largest integrated supplier of solid dosage products and services – providing hard-shell capsules, film and foil barrier solutions, track and trace systems, and process, packing and inspection equipment.

The company has signed a Memorandum of Understanding (MoU) with the state government of Maharashtra to produce 40 billion capsules a year, catering to both Indian and international pharmaceutical and nutraceutical companies. The Maharashtra government has accorded “mega project” status to this undertaking.

As per the announcement, the upcoming facility is estimated to create approximately 1000 direct and indirect jobs by 2023 in the region. The announcement also mentioned that the proposed plant will employ sustainable design principles from the internationally recognized Leadership in Energy and Environmental Design (LEED) and be powered significantly by renewable energy sources.

ACG intends to set new benchmarks at the capsule-making and research facility by employing automation and industry 4.0 technologies to minimize resource intensity and ensure products meet global manufacturing practices (GMP).

Overview of India’s pharmaceutical industry

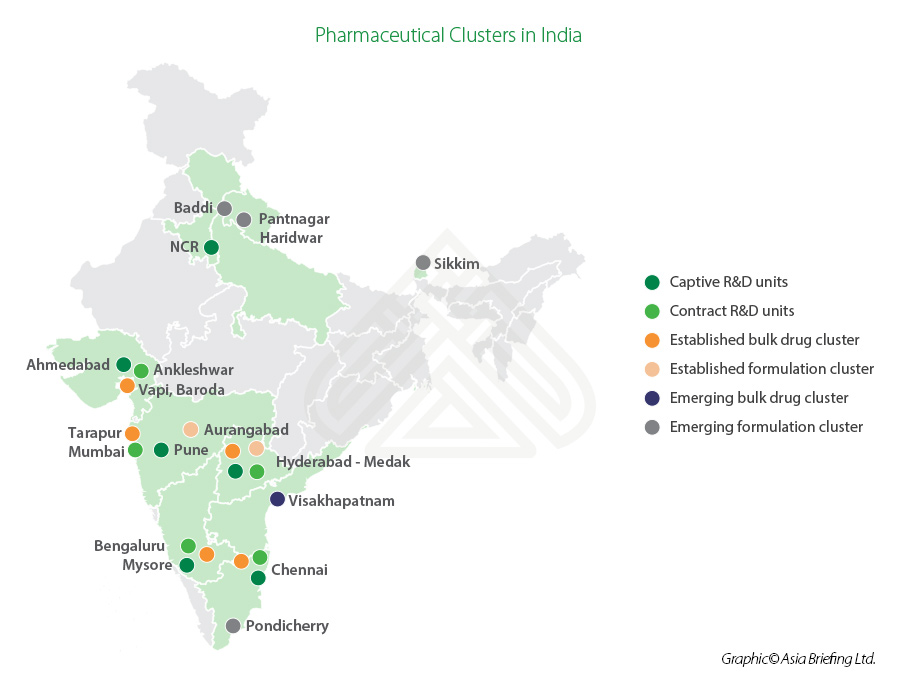

India ranks third globally in terms of pharmaceutical production by volume and 14th in terms of value. The Indian states of Andhra Pradesh, Gujarat, Maharashtra, and Goa are major pharmaceutical manufacturing clusters in the country. The bulk drug clusters are located in Gujarat (Ahmedabad, Vadodara), Maharashtra (Mumbai, Aurangabad, Pune), Telangana (Hyderabad), Tamil Nadu (Chennai), Karnataka (Mysore, Bangalore), and Andhra Pradesh (Visakhapatnam).

India’s pharmaceutical sector caters to over 50 percent of global vaccine demand, 20 percent of global generic medicine demand by volume, and 25 percent of all medicines in the UK.

The pharmaceutical industry in India was estimated to be worth US$42 billion in 2021, with a network of around 3,000 drug companies and 10,500 manufacturing units. It is further expected to expand up to US$65 billion by 2024 and US$120-130 billion by 2030. According to an OECD estimate, India’s pharmaceutical industry will grow by 317 percent between 2017 and 2060 to lead the global pharmaceutical market, followed by Indonesia.

Some of the major domestic players in the industry include Sun Pharmaceutical Industries, Cipla, Lupin, Dr. Reddy’s Laboratories, Aurobindo Pharma, Zydus Cadila, Piramal Enterprises, Glenmark Pharmaceuticals, and Torrent Pharmaceuticals.

India’s current foreign direct investment (FDI) policy allows 100 percent FDI under automatic route in greenfield pharmaceutical projects and 74 percent FDI under the automatic route in brownfield projects.

Additionally, the Indian pharmaceuticals market is supported by the following production linked incentive (PLI) schemes to boost domestic manufacturing capacity, including high-value products across the global supply chain. The implementing agency for these schemes is the Department of Pharmaceuticals.

- PLI scheme for Key Starting Materials (KSMs)/Drug Intermediates (DIs) and Active Pharmaceutical Ingredients (APIs) (PLI 1.0)

- PLI scheme for Pharmaceuticals d (PLI 2.0)

On November 26, 2021, it was reported that 55 companies have qualified for the pharmaceutical sector’s PLI scheme. The list includes leading players like Sun Pharmaceuticals, Cipla, Dr Reddy’s Laboratories, Glenmark Pharmaceuticals, Wockhardt, Biocon, Biological E, Panacea Biotec, Torrent Pharma, Aurobindo Pharma, Intas Pharma, Natco Pharma, and Lupin.

The beneficiaries approved for the scheme also include 20 micro, small and medium enterprises (MSMEs).

The PLI 2.0 scheme will provide financial incentives worth INR 150 billion (US$1.99 billion) on the incremental sales of pharmaceutical goods and in-vitro diagnostic medical devices over six years.

The Small Industries Development Bank of India (SIDBI) is the PLI scheme’s project management agency.

India’s contract manufacturing organization (CMO) market

The concept of contract manufacturing has rapidly evolved in India because of the growing presence of multinational pharmaceutical companies.

India holds an edge over countries like Vietnam, China, and Ireland in manufacturing medical drugs and products due to the presence of key resources – large labor market, technically skilled workforce, and WHO-GMP approved production premises.

As per the Indian Drug Manufacturers’ Association, the pharmaceutical contract manufacturing industry in India is witnessing a growth of 20 percent, which provides great opportunities for small and medium enterprises (SMEs). The current market value is estimated at 50 percent of the domestic production, which roughly translates to US$5.3 billion.

Furthermore, the Indian CMO market is expected to register a compound annual growth rate (CAGR) of 13.3 percent during the period of 2021-2026, fueled by higher return on investment and therapeutic efficiency. The rise in demand for injectable drugs, especially in cancer research, will create higher value in the Indian pharmaceutical contract manufacturing market. Injectable drugs offer higher returns as compared to other drug formulation types.

Some of the leading pharma contract manufacturing companies in India include Gracure Pharmaceuticals Ltd., Nvron Life Science Ltd., Kremoint Pharma Pvt. Ltd., Makcur Laboratories Ltd., etc.

Pharmaceutical R&D in India

According to data from Statista, Indian pharmaceutical companies spend less than 13 percent of their annual turnover on research and development (R&D). In FY 2020, the highest expenditure on R&D was made by Lupin at US$225 million, followed by Dr Reddy (US$204) million and Cipla (US$173 million).

In October 2021, the Department of Pharmaceuticals (DoP) released a draft policy to catalyze R&D in the pharmaceutical-medical technology (pharma-medtech) sector to make India a leader in drug discovery and innovative medical devices. This policy has a 10-year perspective, and will be implemented through an Action Plan defining roles, responsibilities, activities, targets, and timelines. The Action Plan will further be broken down to five-year and annual activities for ease of implementation. A high-level task force will be set up in the DoP to guide and review the implementation of the policy.

The Draft Policy to Catalyze Research & Development and Innovation in the Pharma-MedTech Sector in India primarily focuses on:

- Simplifying regulatory processes to enable rapid drug discovery and development and innovation in medical devices.

- Exploring mechanisms to incentivize private sector investment in research, evaluate various funding mechanisms, including budgetary support, venture capital, CSR funding, etc., and provision of fiscal incentives to support innovation.

- Strengthening the R&D ecosystem through increased collaboration between industry and academia in order to develop mechanisms to dovetail research as per requirement of the industry.

Recently speaking at the Global Innovation Summit organized by the Indian Pharmaceutical Alliance in November 2021, Amitabh Kant (CEO, NITI Aayog) asked the Indian pharmaceutical industry to focus on R&D and innovation in emerging technologies in the pharmaceutical sector in order to position Indian pharma sector at the top in global landscape.

This article was originally published on November 25, 2021. It was updated on November 26, 2021.

About Us

India Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Delhi and Mumbai. Readers may write to india@dezshira.com for more support on doing business in in India.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, Singapore, Vietnam, Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Why Are We Paying Close Attention to the 2021 Winter Session of India’s Parliament? A Look at Key Bills

- Next Article Selling Merchandise Online in India: Market Entry Strategy, Tax Liability, Regulations