Relocating Your Business Operations to India: A Guide for US Investors

- India has shown a strong economic track-record, despite the pandemic blip, and key reforms to liberalize market access and ease doing business make the country an attractive investment destination for US investors.

- Besides improvements to the business climate, most sectors are open to foreign investors.

- India’s digital economy offers some of the brightest prospects with over 300 million internet subscribers.

- Further, India has a significant and growing middle-class, presenting new customers for US businesses in areas from consumer durable goods to automobiles to healthcare.

India is the sixth largest economy in the world based on nominal GDP and third largest by purchasing power parity (PPP). It is the second most populated country with over 1.38 billion people and the largest democracy in the world. India boasts of a range of industries and a huge youth cohort driving investments and market consumption and supporting a diversified labor market supply.

In recent years, the government has embarked on a series of reforms to spur economic growth, such as the introduction of a bankruptcy code, implementation of the goods and services tax to integrate the national market, and several ease of doing business reforms. Many states now have a functional Single Window Portal that function as a single point of contact for starting a business and to secure permits and approvals from relevant government departments. Most states now permit users to register for online services across departments, such as land, labor, environment and tax, and utilities. These reforms improve transparency, speeds up investment facilitation, and introduces predictability for businesses.

India has also introduced corporate tax breaks and made changes to the eligibility criteria for the micro, small, and medium-sized enterprises (MSMEs) to combat the slowdown caused by the COVID-19 pandemic and incentivize private sector participation.

Earlier this month, the government extended its flagship manufacturing incentive scheme to benefit several more sectors. The Production-Linked Incentive (PLI) Scheme previously benefited three major industries – mobile manufacturing and electric components, pharmaceutical (critical key starting materials/active pharmaceutical ingredients), and medical device manufacturing. Now, the PLI scheme will apply to specific product lines in 10 additional sectors – ACC battery production, electronics and technology, automobiles and auto components, pharmaceutical drugs, telecom and networking products, textile products, food products, high efficiency solar PV modules, white goods, and specialty steel.

Through targeted incentives in key manufacturing industries, India wants to establish core competencies and strengthen technology capacity so that its companies can effectively integrate into the global supply chain in various sectors. This will in turn boost employment generation and spur domestic consumption, accelerate exports, and reduce import dependencies. US investors should take advantage of these newly launched incentive schemes that seek to establish large manufacturing facilities and an ecosystem to cater to production efficiency and economies of scale.

In terms of the liberalization of its foreign direct investment (FDI) regime, India also launched its Consolidated FDI Policy 2020, which shows that most sectors are open to foreign investors. Restrictions are placed only on specific areas that are linked to issues of national security, which are clearly stipulated. The policy streamlines the investment regulatory process and ensures 100 percent FDI without needing government permission (automatic route) across several sectors, such as automobiles, electronics system design and manufacturing, medical devices, food processing, software and business and management consultancy services, greenfield pharmaceutical (in brownfield pharma, it is 74 percent under automatic route and thereafter needing government approval), and greenfield healthcare investments (for brownfield projects, 100 percent FDI is allowed upon government approval), to mention a few.

Further, respective state governments in India have drawn out policies to incentivize targeted manufacturing industries – setting aside land, creating local ecosystem catering to specific industries, offering tax breaks linked to production investment and local staffing etc.

India has also introduced important reforms in its labor legislation, amalgamating multiple laws into four major labor codes to ease compliance and hiring decisions for companies.

Dustin Daugherty, Head of North America Business Development at Dezan Shira & Associates’ USA Offices notes: “For US businesses long accustomed to China’s immense labor pool and industrial capacity, India now presents an attractive alternative to China’s perceived belligerence by many US executives. Especially in potentially sensitive sectors, such as technology and electronics manufacturing, the pressure applied by the outgoing Trump administration on companies to shift supply chains and innovative enterprises out of China has allowed US firms to overcome prior concerns about the business climate in India and now view the country as a leading and strategically attractive China alternative.

“Although the incoming Biden administration is likely to reverse many Trump era policies, there is a good chance that in regard to trade policy towards China, there will not be a radical change in substance. The desire to decouple from China and protect intellectual property rights transcends even the polarized partisan atmosphere in Washington DC. Certainly, many US firms still have concern over what they perceive as India’s faults as a place to do business, namely, bureaucratic inefficiency, uncompetitive corporate taxation, and a general concern about the ease of doing business. Nevertheless, these concerns have waned over the past months and many US commentators feel India has made commendable improvements recently, such as recent tax reforms.

“While India will have fierce competition from economic rivals like Vietnam – a current darling of the US business community – the indicators for increased US investment in key manufacturing sectors looks promising, even with the upcoming change in administration. Developments in the US-India relationship have traditionally been slow and steady, and there have been many false starts in the past. But the current confluence of shared economic and political interests indicates to me at least that we may finally see the bilateral economic relationship of these two natural partners live up to its full potential in the coming months and years ahead.”

This article is part two of a two-part series that highlights sector-based investment opportunities in India, attractive locations to set up in the country, incentive schemes, and what market entry options are available to US investors. In the first article, we briefly looked at India’s demographic and economic profile, US-India bilateral trade, US FDI into India, and India’s leading investment segments.

Where to locate your investment?

What sectors should US companies invest in?

Electronics system design and manufacturing (ESDM)

The Indian electronics market is set to grow exponentially – facilitated by its low-cost manufacturing base, huge local demand, and a rapidly developing electronics ecosystem.

The electronics market valued at US$120 billion in 2018-19 is segmented as mobile phones (24 percent), consumer electronics (22 percent), strategic electronics (12 percent), computer hardware (7 percent), LEDs (2 percent), and industrial electronics (34 percent) comprising of auto, medical, and other industrial electronic products.

Domestic electronics production in the country increased from US$11 billion in FY 2009-10 to US$20.8 billion in FY 2018-19, with a year-on-year growth of seven percent (excluding the assembly of imported printed circuit boards).

India is expected to have a digital economy worth US$1 trillion by 2025 and has among the largest electronics markets in the world, which is expected to reach US$400 in value by 2025. In recent years, the Make in India and Digital India initiatives have unveiled various schemes targeting this digital economy and propelling its industrial growth.

Overall, the electronic components manufacturing industry provides employment to over 2 million people, out of which mobile phone manufacturing accounts for 600,000 jobs. Out of the domestic electronic components worth US$9.9 billion produced in 2018-19, components worth US$2.2 billion were exported.

100 percent FDI is allowed under the automatic route for the ESDM sector. In case of electronics items for defense, FDI up to 49 percent is allowed under automatic route and beyond that it is subject to government approval.

Below, we briefly explain three incentive schemes introduced by the government to boost local manufacturing, expand India’s electronics ecosystem, and support export-led production.

Scheme I: Production linked incentive scheme (PLI) for large scale electronics manufacturing

This scheme offers a financial incentive to increase domestic production and boost large investments for electronics, including mobile phones, electronic components, and assembly, testing, marking, and packaging (ATMP) units.

The tenure of the scheme is five years after the base year as defined (FY 2019-20). It provides an incentive of four to six percent on incremental sales (over base year) of goods manufactured in India. The target segments are mobile phones and specified electric components and eligibility will be subject to thresholds of incremental investment and incremental sales of manufactured goods.

Scheme II: Promotion of manufacturing of electronic components and semiconductors (SPECS)

This scheme aims to strengthen the domestic electronics supply chain of components.

The scheme will open for applications for three years. Investments made within five years from the date of acknowledgement are eligible for receiving incentives. An incentive of 25 percent will be provided on capital expenditure pertaining to plant, machinery, equipment, and associated utilities and technology, including research & development, on reimbursement basis. The scheme’s target beneficiaries are electronic components, semiconductors, specialized sub-assemblies, and capital goods for these items. Eligibility is applicable to investments in new units and expansion of existing units.

Scheme III: Modified electronics manufacturing clusters scheme (EMC 2.0)

This scheme aims to strengthen the existing infrastructure for the electronics industry and establish facilities for large manufacturers and value chain companies.

Its objectives include the development of industry-specific facilities like common facility centers, ready built factory, sheds/plug and play facilities to strengthen supply chain responsiveness and promote the consolidation of suppliers. These developments will also decrease the time-to-market and lower logistics costs. EMC 2.0, therefore, provides financial incentives for creating quality infrastructure as well as common facilities and amenities for electronics manufacturers.

The scheme will be open for applications for three years. A further period of five years will be available for disbursement of funds. Financial incentives of up to 50 percent of project cost will be awarded, subject to a ceiling of INR 700 million (US$9.36 million) for every 100 acres of land.

Eligibility:

- Requirement of anchor units

- Purchase/lease at least 20 percent of the land area

- A minimum investment commitment of INR 3 billion (US$40.25 million)

- Expansion related projects

- Minimum land area of 100 acres

- 80 percent of saleable/leasable land should be allotted to EDSM units

- At least 50 percent of land allotted should have started production activity

- Common facility centers (CFC)

- 75 percent of the project cost will be awarded, subject to a ceiling of INR 750 million (US$10.05 million)

- Five electronics manufacturing units identified as users

Medical devices manufacturing sector

The medical devices industry in India consists of large multinational firms and small and medium enterprises (SMEs). The current market size of the medical devices industry in India is estimated to be around US$11 billion and is expected to reach US$50 billion by 2025.

100 percent FDI is allowed under the automatic route for both brownfield and greenfield setups. Strong FDI inflows reflect the confidence of global players in the Indian market – Singapore, United States, Europe, and Japan are key investors and equipment & instruments, consumables, and implants have attracted most FDI.

There is a heavy reliance on imports and India now wants to establish itself as a global manufacturing hub of medical devices.

To achieve this, the below schemes have been designed to incentivize and build large-scale manufacturing capacity.

Scheme I: Production linked incentive scheme for promoting domestic manufacturing of medical devices

Large investments are needed to be able to produce medical devices needed for the purposes of radiology, imaging, implants, anesthetic devices, and cancer care services.

The tenure of this scheme is from FY 2020-21 to 2026-27. It offers an incentive of five percent on incremental sales (over base year FY 2019-20) of goods manufactured in India. There is a broad range of target segments, including capital equipment, implants, and consumables. Eligibility of the beneficiaries is subject to meeting the incremental investment and incremental sales threshold.

Other eligibility criteria include:

- Support to be provided to companies registered and manufacturing of target segments in India and having net worth (of applicant company including that of group companies) greater than INR 180 million (US$24.12 million)

- Scheme exclusive to greenfield projects defined under the guideline

- Applicant should not have been declared as bankrupt or defaulter or reported as fraud by any financial institution

- Eligibility under the PLI scheme will not affect eligibility under any other scheme and vice-versa

Scheme II: Promotion of medical device parks

The scheme aims to strengthen and develop a robust domestic infrastructure and ecosystem for medical devices. Grants under this scheme seek to achieve the creation of world-class infrastructure facilities for domestic production and deepening the value chain of medical devices. This is also expected to lower the cost of domestic manufacturing and, ultimately, better accessibility to medical devices.

The tenure of this scheme is from FY 2020-21 to FY 2024-25. The financial incentive is a grant of up to INR 1 billion (US$13.40 million) per park and the government has set aside an outlay of INR 4 billion (US$53.60 million) to provide financial assistance for building common infrastructure for four medical parks to be set up across four states. In 2019, Andhra Pradesh, Telangana, Tamil Nadu, and Kerala received in-principle approval from Government of India for new medical devices parks.

Food processing industry

A sunrise sector, India’s food ecosystem offers attractive fiscal incentives and favorable economic policies for foreign investors. India is the world’s largest processor, producer, consumer, and exporter of cashew nuts, spices, food grains, fruits, and vegetables. It is the sixth largest food and grocery market in the world and accounts for 65 percent of India’s total retail market.

From April 2000 till June 2020, the total FDI inflows into the food processing industry amounted to US$10.1 billion. India permits 100 percent FDI in this industry under the automatic route. 100 percent FDI is allowed through the government approval route for trading, including through e-commerce for food products manufactured or produced in India.

On November 11, the government announced that its production-linked incentive (PLI) scheme would benefit food products, with an outlay worth INR 109 billion (US$14.59 billion), earmarked for a five-year period. Specific product lines showing high growth potential and able to generate medium- to large-scale employment will be supported under this scheme. The product lines are: ready to eat (RTE) and ready to cook (RTC), marine products, fruits and vegetables, honey, desi ghee, mozzarella cheese, organic eggs, and poultry meat.

The processed food market is expected to grow to US$543 billion by the end of 2020. Currently, the industry employs 1.85 million people and puts out an aggregate output worth US$158.69 billion.

Pharmaceuticals

India is the largest provider of generic medicines globally, occupying a 20 percent share in the global supply by volume, and supplies 62 percent of the global demand for vaccines. India ranks third worldwide for production by volume and 14th by value.

India has the largest number of US-FDA compliant pharmaceutical plants (more than 262 including active pharmaceutical ingredients) outside of the United States. India has more than 2,000 WHO-GMP approved pharmaceutical plants and 253 European Directorate of Quality Medicines (EDQM)-approved plants.

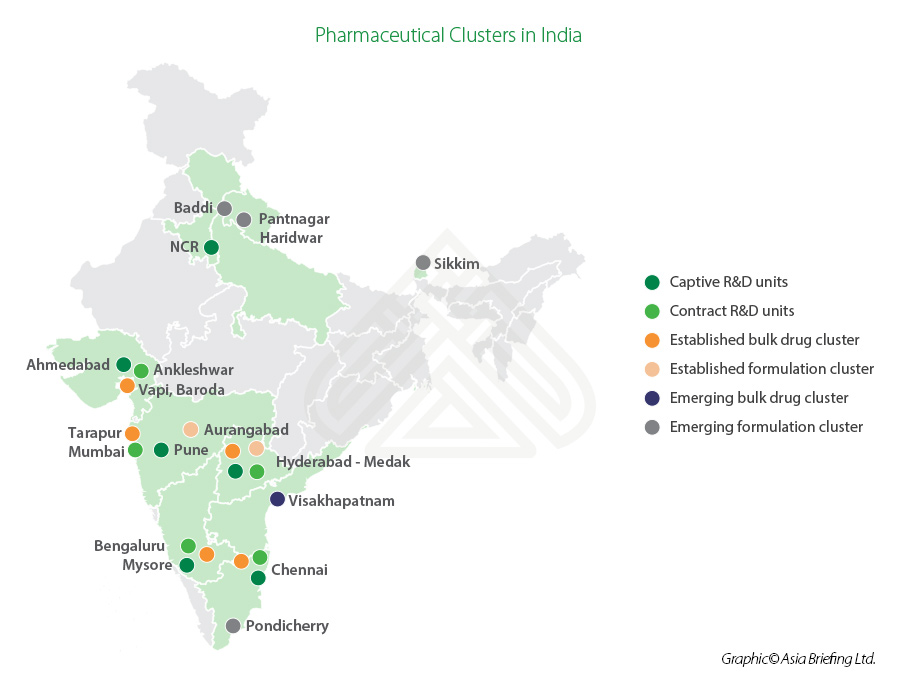

India is the source of 60,000 generic brands across 60 therapeutic categories and manufactures more than 500 different active pharmaceutical ingredients (APIs). The country is home to more than 3,000 pharmaceutical companies with a strong network of over 10,500 manufacturing facilities. The domestic pharmaceuticals market turnover reached US$20.03 billion in 2019, up 9.3 percent from 2018, growing as the penetration of health insurance policies and pharmacies increases in the country.

In 2018-19, India’s pharmaceuticals exports were worth US$19.3 billion, showing a growth of 10.72 percent year on year. India holds 12 percent of all global manufacturing sites catering to the US market. The cost of manufacturing in India is approximately 33 percent lower than that of the US.

100 percent FDI is allowed under the automatic route for greenfield pharmaceutical investments. 100 percent FDI is allowed in brownfield pharmaceutical investments – where 74 percent is allowed under the automatic route and thereafter, through government approval route.

Scheme I: Production linked incentive scheme for promoting domestic manufacturing of critical KSMs, DIs, and APIs

India has approved the Production-Linked Incentive (PLI) scheme for the promotion of domestic manufacturing of critical key starting materials (KSMs), drug intermediates (Dis), and active pharmaceutical ingredients (APIs) in set ups based in the country.

The PLI scheme targeting this segment of the pharmaceutical sector was notified by the government in July 2020. A financial incentive will be given to eligible manufacturers of identified 41 eligible products that covers 53 APIs, for six years, based on threshold investment and domestic sales made by the selected applicant for the eligible products. The rates will vary for fermentation-based products and chemically synthesized products. PLI worth up to INR 69.4 billion (US$932.15 million) have been approved.

Interested US investors are advised to check the timeline for applying for benefits under the PLI incentive scheme as well as their eligibility as the sector is highly competitive.

Information technology and business process management services

The IT-BPM industry is the largest employer within the private sector in India. India’s IT industry includes more than 17,000 firms, of which over 1,000 are large firms with over 50 delivery locations in India.

Industry experts find that India’s cost competitiveness in providing IT services is approximately three to four times more cost-effective than the US and this continues to be its unique selling proposition in the global sourcing market.

The IT-BPM industry stood at US$177 billion in 2019 and is expected to grow to US$350 billion by 2025.

Major MNC investors in this sector include Accenture, Cognizant, HP, Capegemini, IBM, Microsoft Corp., Intel, Dell, Oracle, Qualcomm etc.

Major IT-BPM clusters in India are Delhi-NCR, Maharashtra, Karnataka, Tamil Nadu, Telangana.

What corporate structure should US companies operate from?

Investors should assess their specific needs carefully before deciding which corporate structure to operate from. Using a reliable local advisor is recommended for first-time investors in the country as they find it easier to remain compliant with applicable regulations.

While setting up in India, foreign companies should choose an entity structure that caters best to their need. Selection of the right entity structure will help the company establish itself as a strong player in the Indian market, and also help them reap financial gains.

A foreign investor or company may set up as an unincorporated entity or incorporated entity in India. Unincorporated entities permit a foreign company to do business in India by establishing a liaison office, branch office, project office, or a trust. An incorporated entity, like a limited liability partnership or a wholly owned subsidiary is considered a separate legal entity, and has more structured setup.

Popular legal options for foreign investors looking to set up in the country include liaison office, a wholly owned subsidiary (WOS), and a joint venture. In the below table, we provide a snapshot view of all the types of corporate investment allowed in India and their comparative advantages. We also briefly explain the WOS and JV corporate structures.

Setting up a wholly owned subsidiary

A wholly owned subsidiary (WOS) operates as an independent legal entity whose 100 percent common stock is owned by another company, the parent company. The WOS can be a part of the same industry as its parent company or a part of an entirely different industry.

For foreign investors, the WOS allows them to have control over business operations, provide limited liability, and see fewer restrictions on business activities compared to a liaison office or project office. However, the activities must be in accordance with the FDI policy.

Foreign companies can set up wholly owned subsidiaries in the form of private limited companies in sectors where 100 percent FDI is permitted. A private limited company is a business entity held by a small group of people.

Requirements to set up a WOS

At least two directors, with one being an Indian resident, must be appointed and registered through India’s e-filing system for Director Identification Numbers (DIN). A minimum authorized share capital of INR 100,000 (US$1,400), two directors, and two shareholders (who can be same as the directors) are required to establish a private limited company.

The following form along with requisite documents must be filed with the Ministry of Corporate Affairs for establishing a WOS in India:

- SPICe+ for incorporation of the company.

Once the documents are submitted, the RoC will issue a Certificate of Incorporation and a Corporate Identification Number. It takes about four to five weeks to complete the process. The commencement of business certificate must be obtained within 180 days of incorporation of the company by filing Form INC 20A with the RoC. The WOS will be subjected to Indian taxes and laws as applicable to other domestic companies in India. Under this structure, companies have to pay Corporate Income Tax (CIT).

Entering into a joint venture

A joint venture is a partnership between two or more companies or individuals who agree to pool capital or goods into a uniform project. Joint ventures in India have been most popular for sectors that do not have 100 percent FDI.

Joint ventures offer relatively low risk to foreign companies, provided that these companies conduct due diligence on their Indian partners. A joint venture allows foreign companies to utilize the existing networks of their Indian partners, and once taxed, such companies can remit their Indian profits outside the country.

A JV may be formed with any of the business entities existing in India. Corporate JVs will also be subject to the country’s tax laws, FEMA, labor laws (such as Code on Wages Act, 2019, Industrial Disputes Act, 1947, and state-specific shops and establishment legislation), the Competition Act of 2002, and various industry-specific laws.

Requirements to set up a JV

Once a partner/associate company is selected, a memorandum of understanding (MoU) or a letter of intent is signed by the parties. An MoU and a joint venture agreement/shareholders’ agreement must be marked after consulting a chartered accountant firm well versed in the FEMA; Indian Income Tax Act, 1961; the Companies

Act, 2013; international laws and applicable Indian rules, regulations, and procedures. Terms and conditions should be properly assessed before signing the contract. The JV union should obtain all the required governmental approvals and licenses within a specified period.

Foreign companies no longer require a no-objection certificate (NOC) from the Indian associate for investing in the sector where the joint venture operates. Therefore, foreign firms in existing joint ventures can function independently in the same business segment. Previously, they needed prior approval from their Indian partners.

Before signing a joint venture contract, the below points must be properly assessed:

- Applicable law;

- Shareholding pattern;

- Composition of board of directors;

- Management committee;

- Frequency of board meetings and its venue;

- General meeting and its venue;

- Composition of quorum for important decision at board meeting;

- Transfer of shares;

- Dividend policy;

- Employment of funds in cash or kind;

- Change of control;

- Restriction/prohibition on assignment;

- Non-compete parameters;

- Confidentiality;

- Indemnity;

- Break of deadlock;

- Jurisdiction for resolution of dispute; and

- Termination criteria and notice.

India’s taxation regime

Corporate taxation

Any company registered under the Companies Act, or any foreign company that has its place of effective management in India will be considered as a domestic company. All income earned by a domestic company is taxed under corporate income tax. For foreign companies, only the income received or accrued in India is taxed under corporate taxation.

To encourage investment in the manufacturing sector, the Indian government has taken proactive steps, including offering competitive tax rates. In 2019, the corporate tax rate was reduced in India for the first time in three decades, and the manufacturing sector benefited the most from the slashed tax rate.

Domestic companies can choose to pay tax at the rate of 22 percent subject to condition that they will not avail any exemption/incentive. The effective tax rate for these companies shall be 25.17 percent inclusive of surcharge and cess. Also, such companies shall not be required to pay minimum alternate tax (MAT). MAT is the minimum amount of tax that a company is obliged to pay in case its normal tax liability after claiming deductions falls below a certain threshold.

A company that does not opt for the concessional tax regime and avails the usual tax exemptions/incentives shall continue to pay tax at the pre-amended rate. However, these companies can opt for the concessional tax regime after expiry of their tax holiday/exemption period. However, once such a company opts for the concessional tax rate (section 115BAA of the Income Tax Act,1961), it cannot be subsequently withdrawn.

Any new domestic company incorporated on or after October 1, 2019 and making fresh investment in manufacturing, can opt to pay income tax at the rate of 15 percent (section 115BAB, Income Tax Act, 1961). This benefit is available to companies that do not avail any exemption/incentive and commence their production on or before March 31, 2023. The effective tax rate for these companies shall be 17.01 percent inclusive of surcharge and cess. Also, such companies shall not be required to pay MAT. The new manufacturing company has to exercise the option on or before the due date of filing tax returns, which is usually September 30 of the assessment year, unless extended. To be noted, once the company opts for section 115BAB in a particular financial year, it cannot be withdrawn subsequently.

Individual income tax

In a bid to simplify income tax for individual taxpayers, Finance Minister Nirmala Sitharaman announced a new, alternative, tax regime with revised income tax slabs and tax rates during the 2020 union budget.

Taxpayers will have the option to either use the new tax regime or the existing tax regime to file their taxes. However, determining which tax regime is best suited will depend largely on their income and investments, among other factors.

The existing tax system will continue without any changes, and the new tax system is expected to be effective from financial year (FY) 2020-21.

Currently 130 deductions and exemptions are available under the existing tax regime, but around 70 have been removed for individuals who wish to opt for the new tax regime. So, under the new tax regime individuals will not be entitled to any other exemptions, such as the standard deduction of INR 50,000 (US$702), leave travel concession (LTA), house rent allowance (HRA), provident fund contributions, and tax exemptions on donations to charitable institutions, to name a few.

However, if the taxpayer chooses to continue with the existing tax regime, they will be allowed to claim all the current tax deductions and exemptions, including HRA, LTA, medical insurance premium, interest paid on housing and education loan, and public provident fund contributions when assessing their income tax liability.

About Us

India Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Delhi and Mumbai. Readers may write to india@dezshira.com for business support in India.

- Previous Article Medizinprodukte in Indien: Schlüsselüberlegungen für ausländische Investoren und Importeure

- Next Article India at the Crossroads: The Free Trade Options After Rejecting RCEP