Roll-Out of Manufacturing Incentives in India’s Pharmaceuticals Sector: Approved Beneficiaries and New PLI Scheme Criteria

PLI schemes are a part of India’s strategy to boost local manufacturing capacity and move up value chains, including in pharmaceuticals.

India wants to attract greater investments from global and domestic players in its pharmaceuticals sector, which is mostly known for its low value generic drugs production.

Through targeted interventions, such as the production-linked incentive (PLI) scheme, India seeks to develop its high-value production capacities, ensure product diversification, lessen import dependency for patented drugs, and create world class R&D facilities.

After the experience of the pandemic, India is keen to secure its drugs market from external shocks, lessen import dependencies, and continue support for the domestic production capabilities in active pharmaceutical ingredients (APIs), key starting materials (KSMs), and drug intermediates (DIs). These will also contribute to maintaining affordable healthcare costs.

Towards this, the Department of Pharmaceuticals launched a PLI scheme last year for the promotion of domestic manufacturing by setting up greenfield plants with stipulated minimum domestic value addition in four different target segments:

- key fermentation based KSMs/DIs and niche fermentation based KSMs/DIs (at least 90 percent value addition)

- key chemical synthesis based KSMs/DIs and other chemical synthesis based KSMs/DIs (at least 70 percent value addition)

The total outlay for the scheme is INR 69.4 billion (US$951 million) for the period 2020-21 to 2029-30.

On February 28, this year, the government approved a PLI scheme for the pharmaceutical sector with an outlay of INR 150 billion (US$2.05 billion).

India’s pharmaceutical industry is currently valued at US$41 billion and is expected to reach US$65 billion by 2024 and US$120 billion by 2030.

Beneficiaries under last year’s PLI scheme for domestic manufacturing of critical drugs

In total, the government processed 215 applications for 36 products in the four segments; the last date to apply was November 30, 2020.

In January 2021, five pharmaceutical projects were reported as being approved as PLI beneficiaries, whose total committed investment will be worth INR 37.6 billion (US$515 million) to promote domestic manufacture of bulk drugs and APIs. The projects cover four fermentation based KSMs and APIs, such as penicillin G, 7-ACA (7-aminocephalosporanic acid), erythromycin thiocyanate, and clavulanic acid – all are currently imported.

In February, the media reported government approval of 14 projects in two different categories for manufacturing APIs, drug intermediaries, and KSMs – relating to category 2 and 3 technologies. Approved applicants for niche fermentation based KSMs/DIs include Natural Biogenex Pvt Ltd, Symbiotec Pharmalab Pvt Ltd, Macleods Pharmaceutical Ltd, SudarshanPharma Industries Ltd, and Optimus Drugs Pvt Ltd. Approved applicants for key chemical synthesis based KSMs/DIs include Saraca Laboratories Ltd, EmmennarPharma Pvt Ltd, Hindys Lab Pvt Ltd, AartiSpeciality Chemicals Ltd, and Meghmani LLP.

Thus, a total of 19 companies have been approved as PLI beneficiaries for promotion of domestic manufacturing of critical KSMs/DIs/APIs and have committed to investments worth INR 46.23 billion (US$633.76 million). According to official sources, commercial production will begin April 1, 2023, the PLI scheme will be carried over a period of six years, and the disbursal of production-linked incentives by the government will be up to a maximum of INR 48.7 billion (US$667.62 million).

Below is a list of some of the approved companies under the PLI scheme and their products:

- Aurobindo Pharma – Penicillin G

- Karnataka Antibiotics & Pharmaceuticals – 7-ACA

- Aurobindo Pharma – 7-ACA

- Aurobindo Pharma – Erythromycin thiocyanate (TIOC)

- Kinvan Pvt – Clavulanic acid

- Natural Biogenex Private Limited – Betamethasone, Dexamethasone and Prednisolone

- Symbiotech Pharmalab Private Limited – Prednisolone

- Macleods Pharmaceuticals Limited – Vitamin B1 and Streptomycin

- Optimus Drugs Private Limited – Vitamin B1 and Streptomycin

- Sudarshan Pharma Industries Limited – Vitamin B1

- Saraca Laboratories Limited – 1,1 Cyclohexane Diacetic Acid

- Emmennar Pharma Private Limited – 1,1 Cyclohexane Diacetic Acid

- Hindys Lab Private Limited – 1,1 Cyclohexane Diacetic Acid

- Aarti Specialty Chemicals Limited – 2-Methyl-5NitroImidazole

- Meghmani LLP – Para aminophenol

Features of the new PLI scheme announced for the pharmaceuticals sector

The latest PLI scheme for the pharmaceutical sector was announced late February, with the Department of Pharmaceuticals releasing the eligibility criteria on March 3, 2021.

Who are the target groups?

Pharma makers registered in India will be grouped based on their global manufacturing revenue (GMR). The qualifying criteria for the three groups of applicants will be as follows

- Group A: Applicants having GMR (FY 2019-20) of pharmaceutical goods more than or equal to INR 50 billion (US$685 million).

- Group B: Applicants having GMR (FY 2019-20) of pharmaceutical goods between INR 5 billion (US$68 million) (inclusive) and INR 50 billion (US$685 million).

- Group C: Applicants having GMR (FY 2019-20) of pharmaceutical goods less than INR 5 billion (US$68 million). Within this group, a sub-group for micro, small, and medium enterprises in the industry will be made – given their specific challenges and circumstances.

Incentive allocation for target beneficiaries in Group A is INR 110 billion (US$1.50 billion), for Group B is INR 22.5 billion (US$308 million), and for Group C is INR 17.5 billion (US$239 million).

Which categories of pharmaceutical goods are covered?

The PLI scheme will cover three categories of pharmaceutical goods:

Category 1

- Biopharmaceuticals

- Complex generic drugs

- Patented drugs or drugs nearing patent expiry

- Cell based or gene therapy drugs

- Orphan drugs

- Special empty capsules like HPMC, Pullulan, enteric etc.

- Complex excipients

- Phyto-pharmaceuticals

- Other drugs as approved

Category 2

- Active pharmaceutical ingredients, key starting materials, and drug intermediates

Category 3 – drugs not covered in above categories

- Repurposed drugs

- Auto immune drugs, anti-cancer drugs, anti-diabetic drugs, anti-infective drugs, cardiovascular drugs, psychotropic drugs, and anti-retroviral drugs

- In-vitro diagnostic devices

- Other drugs as approved

- Other drugs not manufactured in India

What is the rate of incentive?

The rate of incentive on incremental sales (over base year) of pharmaceutical goods covered under Category 1 and 2 will be 10 percent for FY 2022-23 to FY 2025-26, eight percent for 2026-27, and six percent for 2027-28.

The rate of incentive on incremental sales (over base year) of for pharmaceutical goods covered under Category 3 will be five percent for FY 2022-23 to FY 2025-26, four percent for 2026-27, and three percent for 2027-28. 3.4.

The financial year 2019-20 shall be treated as the base year for computation of incremental sales of manufactured goods.

What is the tenure of the scheme?

The duration of the scheme will be from FY 2020-21 to FY 2028-29. This will include the period for processing applications (FY 2020-21), optional gestation period of one year (FY 2021-22), incentive for six years, and FY 2028-29 for disbursal of incentive for sales of FY 2027-28.

What is the incentive outlay and is there a ceiling?

The annual incentive outlay is estimated based on projected incremental sales of the identified pharmaceutical goods by the selected participants. The incentives will be paid for a maximum period of six years for each participant. Participants may avail up to one-year gestation period from the date of approval. Incentive per participant will be subject to ceilings which will be specified in the scheme guidelines.

How are beneficiaries selected?

Applicants are selected based on pre-defined objective criteria to assess their experience, capacity to grow in scale and innovate. The selection criteria shall be elaborated in the scheme guidelines.

What are the threshold criteria to be eligible for incentives under the PLI scheme?

The selected participants in the scheme will be eligible for incentives on incremental sales of pharmaceutical goods based on yearly threshold criteria of minimum cumulative investment and minimum percentage growth in sales as mentioned below.

Cumulative investments

Group A

Minimum cumulative investment per participant is INR 10 billion (US$137 million) over five years:

- FY 2021-22: INR 2 billion (US$27 million)

- FY 2022-23: INR 4 billion (US$54 million)

- FY 2023-24: INR 6 billion (US$82 million)

- FY 2024-25: INR 8 billion (US$109 million)

- FY 2025-26: INR 10 billion (US$137 million)

Group B

Minimum cumulative investment per participant is INR 2.5 billion (US$34 million) over five years:

- FY 2021-22: INR 500 million (US$6.8 million)

- FY 2022-23: INR 1 billion (US$13 million)

- FY 2023-24: INR 1.5 billion (US$20 million)

- FY 2024-25: INR 2 billion (US$27 million)

- FY 2025-26: INR 2.5 billion (US$34 million)

Group C

Minimum cumulative investment per participant is INR 500 million (US$6.8 million) over five years:

- FY 2021-22: INR 100 million (US$1.3 million)

- FY 2022-23: INR 200 million (US$2.7 million)

- FY 2023-24: INR 300 million (US$4.1 million)

- FY 2024-25: INR 400 million (US$5.4 million)

- FY 2025-26: INR 500 million (US$6.8 million)

Sales

The minimum percentage growth in sales (year on year) is the same for all three groups:

- For the first year of production, participants shall have to achieve minimum threshold sales, which will be specified by value for each Group in the scheme guidelines.

- For subsequent years, participants must achieve a minimum percentage growth of seven percent year on year.

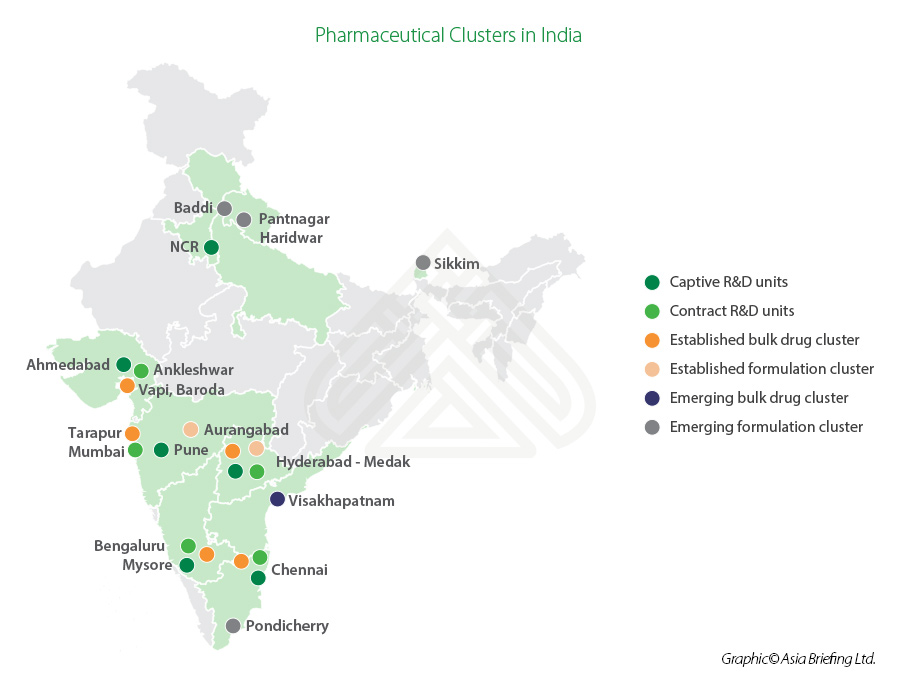

India’s established pharmaceuticals sector clusters

About Us

India Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Delhi and Mumbai. Readers may write to india@dezshira.com for business support in India.

- Previous Article India’s Production-Linked Incentive Scheme for Pharmaceuticals, IT Sectors Among Others

- Next Article India’s DTAA Regime: A Brief Primer for Foreign Investors