India’s Goods and Service Tax

Jun. 7 – India’s goods and service tax (GST) is a nationwide comprehensive indirect tax levied on the manufacturing, sales and consumption of goods as well as services. GST is intended to create a single unified Indian market with fewer complications – in turn making it an attractive investment destination.

Current scenario

Currently, the indirect tax system in India is submerged into a complex network of numerous indirect taxes both at the state and the nation level. It is translucent in nature and also a breeding ground for rampant corruption. At state level, there are taxes such as VAT, octroi, and entertainment tax while at the central level there is the central excise duty and service tax, for example. Set off of tax paid at entry point is allowed at the exit point, but only by the same taxing authority and also subject to many conditions. Currently, a manufacturer needs to pay tax when a finished product moves out from a factory, and it is again taxed at the retail outlet when sold.

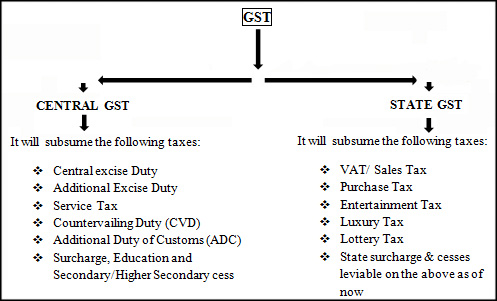

Proposed structure of GST

India is planning to implement a dual GST system. Under dual GST, a central goods and services tax (CGST) and a state goods and services tax (SGST) will be levied on the taxable value of a transaction. All goods and services, barring a few exceptions, will be brought into the GST base. There will be no distinction between goods and services.

Input tax credit (ITC)

Taxes paid against CGST allowed as ITC against CGST. Taxes paid against SGST allowed as ITC against SGST.

Cross utilization of ITC between the CGST and SGST would not be allowed with the exception of inter-state supply of goods and services.

Compliance

- Allotment of a PAN-linked taxpayer identification number with 13-15 digits

- Uniform procedure for collection of both CGST and SGST to be prescribed in the respective legislation

- Single tax invoice for charging and collecting both taxes

- Submission of periodical returns, in common format, to both the CGST and SGST authorities.

Small taxpayers

Small taxpayers whose gross annual turnover is less than 1.5 crore are proposed to be exempted from CGST and SGST.

Rate structure

There will be a standard rate for general goods, with lower for basic necessities and special higher rates for others. Currently, the highest rate on goods is 20 percent and on services is 12 percent. It is expected that the rate of GST will range between 14 percent and 16 percent.

GST on exports

Exports proposed to be fully exempted with zero rates with benefit of refund of input taxes.

GST on imports

- CGST and SGST on imports to replace countervailing duties and additional duties of customs currently levied on imported goods as part of customs duties

- GST paid on imports available as input tax credits

- SGST on import to be levied by the state where goods and services get consumed

Exemptions

Taxes on items containing alcohol and petroleum product are kept out of GST. They will continue to be taxed as per existing practices. Tax on tobacco products will be subject to GST. But the government can levy the extra excise duty over and above GST.

Exports and supplies to SEZ areas are zero rated.

Benefits of GST to the economy

GST will bring about a change on the tax firmament by redistributing the burden of taxation equitably between manufacturing and services. It will lower the tax rate by broadening the tax base and minimizing exemptions. It will reduce distortions by completely switching to the destination principle. It will foster a common market across the country and reduce compliance costs. It will facilitate investment decisions being made on purely economic concerns, independent of tax considerations. It will promote exports. GST will also promote employment. Most importantly, it will spur growth. It is a preliminary estimate India will gain US$15 billion a year.

The date of implementation of GST is set for August 2012. GST might not be implemented before April 1, 2013.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email india@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can also stay up to date with the latest business and investment trends across emerging Asia by subscribing to our complimentary Asia Briefing weekly newsletter.

- Previous Article Retrospective Taxation – Probably Not Applicable to Most Foreign M&A Deals

- Next Article India’s Goods and Service Tax Continues to Face Delays