Sourcing and Procurement from India: Establishing an Office on the Ground

DELHI – For businesses wanting direct control over their sourcing operation in India, establishing a local presence is an integral step. Although creating an office on the ground inevitably necessitates a greater financial and legal burden for the company in question, it is an effective means of ensuring higher performance levels from a sourcing platform.

First of all, the company must decide on what sort of entity they want to establish, from which they will be able to manage their sourcing operation in India by varying degrees of control. In this excerpt from our latest India Briefing magazine, we compare the two most relevant options.

Liaison Office

By far the cheapest and simplest to establish of the two, liaison offices are typically used by foreign companies as a communication channel with their sourcing operation in India. Its functions are described in this graph:

The parent company of an LO must have:

• A three-year record of profitable operations;

• A net worth of at least US$50,000.

They must then:

• First be approved by the Reserve Bank of India (RBI), and register with the Registrar of Companies within 30 days of beginning their operations in India;

• Once approved, they can operate for a maximum of three years, and then request renewal.

![]() An Introduction to Sourcing from India, Part 1: India’s Sourcing Edge

An Introduction to Sourcing from India, Part 1: India’s Sourcing Edge

Whilst an LO is a useful tool for monitoring a sourcing operation in India, and can be established with comparatively minimal expense and legal pressure, its functions and capabilities are notably finite. They cannot undertake any commercial or industrial activities and consequently are unable to manage exports or earn an income in India. The upshot of this condition, however, is that liaison offices are not liable for taxation in India.

For these reasons, a company with an LO would still be taking an ‘indirect’ route to source from India. The principal role of a liaison office is therefore to ensure that suppliers are performing adequately. If a greater level of control is desired, however, a branch office should be selected.

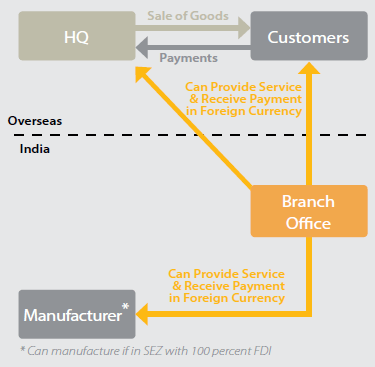

Branch Office

The powers of a branch office are far greater than those of an LO. Most importantly, a BO is able to manage its exports itself. As well as the functions of a liaison office, a BO can best be described as follows:

The parent company of a BO must have:

• A five-year record of profitable operations;

• A net worth of at least US$100,000.

Additionally, a company must:

• Provide details of its operating history, interests in India, and reasons for wanting to open a BO.

![]() An Introduction to Sourcing from India, Part 2: Exporting from India

An Introduction to Sourcing from India, Part 2: Exporting from India

Like an LO, a BO must have prior approval from the RBI before it is established. Once approved, it can then register with the tax authorities, obtain a permanent account number, and be issued visas for its staff.

The only significant restriction placed on a BO is its inability to directly engage in the manufacturing process. This, however, can be bypassed if the office is established in a Special Economic Zone (SEZ), and in a sector that allows 100 percent FDI. Because a BO has powers to export products from India, it is considered a ‘direct’ means of managing a sourcing operation. It is therefore the best option for a company wishing to exercise a high level of control over their sourcing platform.

This article is an excerpt from the November issue of India Briefing Magazine, titled “Establishing Your Sourcing Platform in India“. In this issue, we highlight the advantages India possesses as a sourcing option and explore the choices available to foreign companies seeking to create a sourcing presence here. In addition, we examine the relevant procurement, procedural and tax duty concerns involved in sourcing from India, and conclude by investigating the importance of supplier due diligence – a process that, if not conducted correctly, can often prove the undoing of a sourcing venture.”Establishing Your Sourcing Platform in India” is out now and available as a complimentary download in the Asia Briefing Bookstore. This article is an excerpt from the November issue of India Briefing Magazine, titled “Establishing Your Sourcing Platform in India“. In this issue, we highlight the advantages India possesses as a sourcing option and explore the choices available to foreign companies seeking to create a sourcing presence here. In addition, we examine the relevant procurement, procedural and tax duty concerns involved in sourcing from India, and conclude by investigating the importance of supplier due diligence – a process that, if not conducted correctly, can often prove the undoing of a sourcing venture.”Establishing Your Sourcing Platform in India” is out now and available as a complimentary download in the Asia Briefing Bookstore. |

![]()

Taking Advantage of India’s FDI Reforms

Taking Advantage of India’s FDI Reforms

In this edition of India Briefing Magazine, we explore important amendments to India’s foreign investment policy and outline various options for business establishment, including the creation of wholly owned subsidiaries in sectors that permit 100 percent foreign direct investment. We additionally explore several taxes that apply to wholly owned subsidiary companies, and provide an outlook for what investors can expect to see in India this year.

Passage to India: Selling to India’s Consumer Market

Passage to India: Selling to India’s Consumer Market

In this issue of India Briefing Magazine, we outline the fundamentals of India’s import policies and procedures, as well as provide an introduction to the essentials of engaging in direct and indirect export, acquiring an Indian company, selling to the government and establishing a local presence in the form of a liaison office, branch office, or wholly owned subsidiary. We conclude by taking a closer look at the strategic potential of joint ventures and the advantages they can provide companies at all stages of market entry and expansion.

Trading with India

Trading with India

In this issue of India Briefing, we focus on the dynamics driving India as a global trading hub. Within the magazine, you will find tips for buying and selling in India from overseas, as well as how to set up a trading company in the country.

- Previous Article Understanding India’s Industry-Specific Tax Incentives

- Next Article How to Establish an NGO in India