Digital Rupee Pilot Launch by the RBI on November 1, Targeting Wholesale Segment

India is launching the digital rupee on November 1 on a pilot basis and targeting just the wholesale segment (e₹-W). The Reserve Bank of India (RBI) has identified nine banks for the e₹-W pilot launch – State Bank of India, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, YES Bank, IDFC First Bank, and HSBC Bank.

In its notification on October 31, the RBI also said that the pilot launch of the digital rupee for the retail segment (e₹-R) is planned within a month but it will be available only in closed user groups consisting of merchants and customers.

Earlier, in its concept note on Central Bank Digital Currency (CBDC), also called the digital rupee, the RBI had indicated it would soon commence a limited pilot launch for specific use cases.

The Reserve Bank of India (RBI) will commence the limited pilot launch of the digital rupee in the wholesale segment on November 1, 2022.

In a notification on October 31, the RBI said of the digital rupee’s pilot launch: “The use case for this pilot is settlement of secondary market transactions in government securities. Use of e₹-W is expected to make the inter-bank market more efficient. Settlement in central bank money would reduce transaction costs by pre-empting the need for settlement guarantee infrastructure or for collateral to mitigate settlement risk. The first pilot in Digital Rupee – Retail segment (e₹-R) is planned for launch within a month in select locations in closed user groups comprising customers and merchants.”

Nine banks have been approved by the RBI for the e₹-W pilot launch – State Bank of India, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, YES Bank, IDFC First Bank, and HSBC Bank.

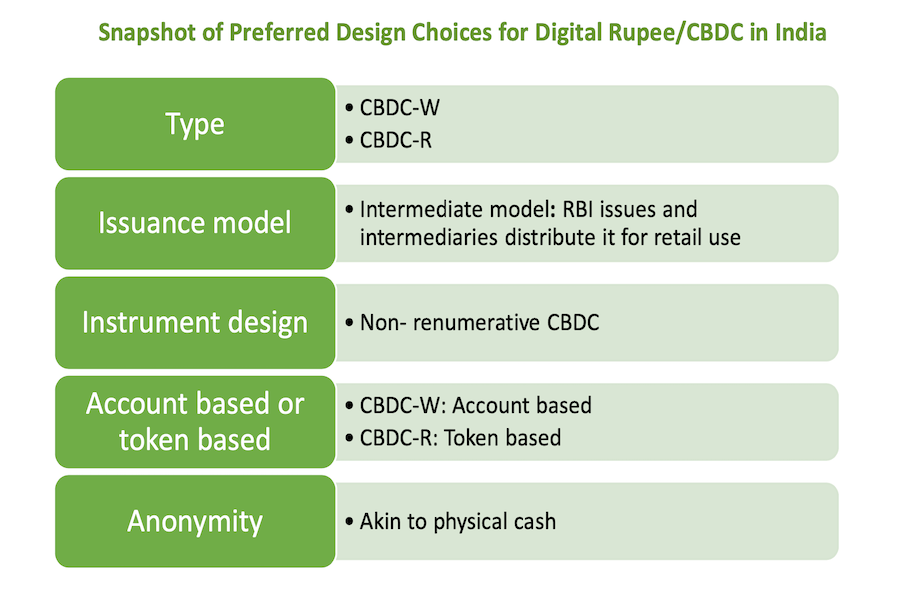

In its concept note on the Central Bank Digital Currency (CBDC) / digital rupee, released on October 7, 2022, the RBI had said that there would be two broad categories for the use of the digital rupee — retail and wholesale – enabling businesses and consumers to use the digital currency seamlessly for various transactions.

In introducing the digital rupee/CBDC, the RBI aims to “bolster India’s digital economy, enhance financial inclusion, and make the monetary and payment systems more efficient.” The central bank has clarified that the “CBDC is aimed to complement, rather than replace, current forms of money and is envisaged to provide an additional payment avenue to users, not to replace the existing payment systems.”

Below is a brief summary of how regulators’ understanding of the digital rupee and its use case scenarios has developed in India.

What is the digital rupee?

As per a 2018 report by CPMI-MC, CBDC or digital rupee is defined as a new variant of central bank money different from physical cash or central bank reserve/settlement accounts. That is, a central bank liability, denominated in an existing unit of account, which serves both as a medium of exchange and a store of value.

The RBI defines the digital rupee as the legal tender issued by the central bank in a digital form and postulates following features for a unit to be called an Indian digital rupee:

- Digital rupee is a sovereign currency issued by the RBI in alignment with their monetary policy

- It appears as a liability on RBI’s balance sheet

- It must be accepted as a medium of payment, legal tender, and a safe store of value by all citizens, enterprises, and government agencies.

- Digital rupee must be freely convertible against commercial bank money and cash

- It must be a fungible legal tender for which holders need not have a bank account

|

Reserve Bank Digital Payment Index (RBI- DPI) |

|

|

Period |

RBI- DPI |

|

March 2018 |

100 |

|

March 2019 |

153.47 |

|

September 2019 |

173.49 |

|

March 2020 |

207.84 |

|

September 2020 |

217.74 |

|

March 2021 |

270.59 |

|

September 2021 |

304.06 |

|

March 2022 |

349.30 |

The RBI-DPI index, which reached 349.30 in March 2022, demonstrates significant growth in adoption and deepening of digital payments across the country since its inception.

What are the different types of digital rupee?

Based on the usage and the functions performed by the digital rupee and considering the different levels of accessibility, the 2018 CPMI-MC report discussed two broad types of digital rupee:

- General purpose or retail (CBDC-R): They are an electronic version of cash primarily meant for retail consumption. They can be available for use by all private sector entities, non-financial consumers, and businesses.

- Wholesale (CBDC–W): They are designed for restricted access by financial institutions. They could be used for improving the efficiency of interbank payments or securities settlement, as seen in the Project Jasper (Canada) and Ubin (Singapore).

Rationale for launching digital rupee in India

India has witnessed notable strides in enablement of digital infrastructure, and has provided a robust ecosystem for the proliferation of Fintech companies. India’s digital payments ecosystem too has achieved remarkable success.

Supported by payment systems that are affordable, accessible, convenient, efficient, safe and secure, the RBI-backed digital rupee system will further propel India’s digital economy, and make the monetary and payment systems more efficient.

Other countries like Sweden, Denmark, Germany, etc. have also adopted CBDCs at a wide scale, owing to various factors like dwindling usage of paper currency and the willingness to make currency-issuance more efficient. Countries with geographical barriers like the Bahamas and the Caribbean, with small and large numbers of islands spread out, have adopted CBDCs to restrict the physical movement of cash.

How is the digital rupee different from other forms of digital money in India?

While money in digital form is predominant in India, for example – in bank accounts recorded as book entries on commercial bank ledgers, the digital rupee would differ from existing digital money available to the public because it would be a liability of the RBI, and not of a commercial bank.

How will the digital rupee function?

The transfer of digital rupee to the general public will be implemented through a token-based system. The party transferring the digital currency must have the recipient’s public key (similar to digital address). The transfer is then made using the recipient’s private key (a unique password) along with the public one.

Although issued by the Indian central bank, commercial banks in the country can distribute digital currency further. One has to hold it in an e-wallet provided by a bank or any registered service provider.

Transactions are likely to be partially anonymous, with possibility of mandatory disclosure for transactions with higher amounts, while those of smaller ones can remain anonymous, just like in cash transactions.

This article was originally published on October 10, 2022. It was last updated November 1, 2022.

About Us

India Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Delhi and Mumbai. Readers may write to india@dezshira.com for more support on doing business in in India.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, Singapore, Vietnam, Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Tax and Incentive Policies to Spur Investment in India’s Healthcare Sector

- Next Article Profiling the Indian SaaS Landscape – A US$1 Trillion Opportunity for Businesses