-

Other Briefings

- Subscribe

US-China Relations in the Trump 2.0 Era: A Timeline

On December 31, 2025, Trump signed a proclamation delaying the increase in tariffs on upholstered furniture, kitchen cabinets, and vanities for another year.

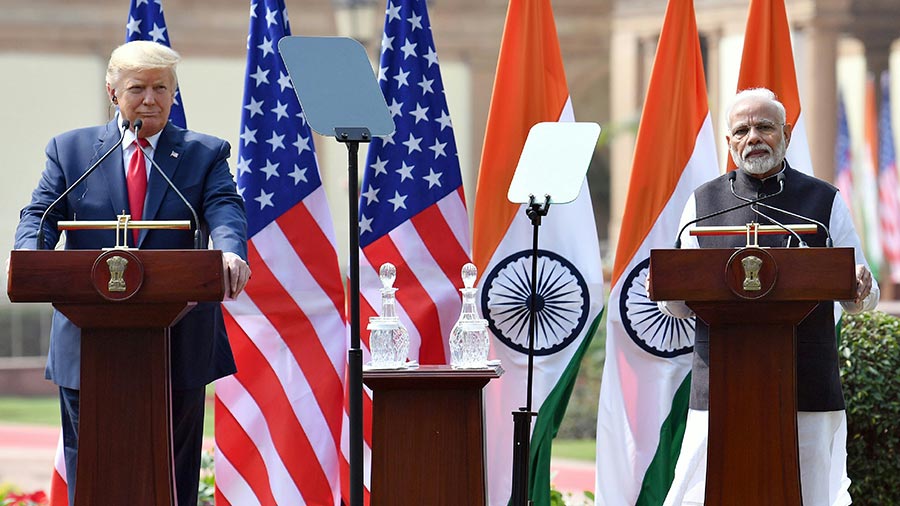

After 10 Months of Tariff Deadlock, US and India Find Common Ground on Trade

The White House has revised its February 2026 factsheet on the interim India-US trade framework, softening procurement language from “committed” to “intends” regarding over US$500 billion in US goods.

US to Reduce Tariffs on Indian Exports Within Days: India's Commerce Minister

The US is set to roll back tariffs on Indian exports from 50 percent to 18 percent within days, according to the commerce minister. The signing of a joint statement, expected between February 11 and 13, 2026, will activate the first phase of the India–US trade framework.

China-UK Relations Turn New Page with Raft of Deals Following Starmer Visit

Agreements reached during the Prime Minister's visit to China are modest, but the trip marks a pivotal moment in warming UK-China ties.

Trump 2.0 at One Year: What US–China Relations Could Look Like in 2026

After a year of upheaval, China and the US have settled into an uneasy but enduring truce. However, unresolved political, regulatory, and security tensions continue to shape the outlook for the year ahead.

China Cuts Import Tariffs to Support High-Tech, Healthcare in 2026 Schedule

The 2026 tariff schedule seeks to support development of key industries while upholding commitments under China's free trade agreements.

US–Vietnam Trade Trends 2025: Top Ports, States, and Sectors

US–Vietnam trade continues to grow, with key states leading most of the activity. Vietnam depends on US exports for production inputs, forming an integrated trade network supported by major transport hubs.

Breaking Down the US-China Trade Tariffs: What's in Effect Now?

The current landscape of US-China tariff rates is complex, with multiple overlapping trade measures in effect. This article explains which tariffs apply in 2025 and how they intersect.

The Top US States Trading with China: Measuring Exposure to the Trade War

2024 trade data highlights uneven state-level exposure to China and underscores how shifting trade dynamics create varying levels of economic impact across the country.

US and China Reach Trade Concessions Following Trump-Xi Meeting: Outcomes and Implications

The meeting in Busan produced a series of trade de-escalation measures, including tariff reductions and the suspension of rare earth export controls and port fees, offering temporary relief to businesses.

How Will China’s Rare Earth Export Controls Impact Industries and Businesses?

China has imposed new restrictions on the export of certain rare earth products, extending oversight to items produced abroad using Chinese technology and materials, potentially further disrputing global supply chains.

US-Vietnam Framework for Trade Agreement: Key Terms and Expectations

The US-Vietnam Framework for an Agreement on Reciprocal, Fair, and Balanced Trade outlines a deeper integration plan beyond tariff changes.

DEZAN SHIRA & ASSOCIATES

Meet the firm behind our content. Visit their website to see how their services can help your business succeed.

About Us Find an AdvisorWant the Latest Sent to Your Inbox?

Subscribing grants you this, plus free access to our articles and magazines.

SUBSCRIBEGet free access to our subscriptions and publications

Subscribe to receive weekly India Briefing news updates, our latest doing business publications, and access to our Asia archives.

Sign Up Now