-

Other Briefings

- Subscribe

Navigating the 2026 Hormuz Blockade: Strategic Implications of the US 30-Day Russian Oil Waiver for India

Explore how the US-Iran-Israel war is disrupting India’s crude oil imports. We provide a deep-dive analysis of the latest US-issued Russian oil waivers, the Strait of Hormuz crisis, and the 2026 energy market trends.

US Tariff Twists: Where Does India Stand and How Will Exporters Get Impacted?

With the US Supreme Court tariff ruling, followed by new solar import duties of 125.87 percent on Indian exporters, India-US trade dynamics are being reshaped, prompting exporters and investors to reassess pricing strategies, supply chains, and tariff risk exposure.

How India's Latin America Expansion Creates New Opportunities for Businesses

As global trade patterns evolve, India is intensifying its outreach to Latin America to diversify export markets and secure critical resources. Rising trade volumes, active FTA and CEPA negotiations, and growing two-way investment signal a structural shift in economic ties, creating new opportunities for manufacturers, exporters, and investors.

India Signs 10-Year Pact with Iran to Operate its Chabahar Port

India and Iran have signed an agreement on bilateral operation of the Chabahar Port, wherein the former will manage Shahid-Behesti terminal.

-

India Eases Port Procedures as Strait of Hormuz Disruptions Force Cargo to Turn Back

Economy & Trade Mar 09 -

DGFT Extends Export Obligation Deadlines for EPCG and Advance Authorization Schemes

Economy & Trade Mar 09 -

Navigating the 2026 Hormuz Blockade: Strategic Implications of the US 30-Day Russian Oil Waiver for India

Economy & Trade Mar 06 -

India's FTA Gambit 2026: Implementation, Expansion, and Strategic Realignment

Economy & Trade Mar 06 -

India-Canada CEPA 2026: Modi-Carney Sign Terms of Reference, Target US$50 Billion Trade by 2030

Economy & Trade Mar 03

Get free access to our subscriptions and publications

Subscribe to receive weekly India Briefing news updates, our latest doing business publications, and access to our Asia archives.

Sign Up Now

Economy & Trade

India Eases Port Procedures as Strait of Hormuz Disruptions Force Cargo to Turn Back

Mar 09India has waived certain port procedures for returned export cargo amid shipping disruptions in the Strait of Hormuz, while DP World offers alternative routing through UAE ports to maintain Gulf trade flows.

-

DGFT Extends Export Obligation Deadlines for EPCG and Advance Authorization Schemes

Economy & Trade Mar 09India’s DGFT has extended export obligation deadlines under the EPCG and Advance Authorization schemes until August 31, 2026, offering compliance relief for exporters.

-

Navigating the 2026 Hormuz Blockade: Strategic Implications of the US 30-Day Russian Oil Waiver for India

Economy & Trade Mar 06Explore how the US-Iran-Israel war is disrupting India’s crude oil imports. We provide a deep-dive analysis of the latest US-issued Russian oil waivers, the Strait of Hormuz crisis, and the 2026 energy market trends.

-

India's FTA Gambit 2026: Implementation, Expansion, and Strategic Realignment

Economy & Trade Mar 05Monitor the 2026 status of all of India’s Free Trade Agreements (FTAs) and CEPAs. This live tracker covers the historic EU deal, UK CETA implementation, and ongoing negotiations with Canada, the GCC, and the US.

-

India-Canada CEPA 2026: Modi-Carney Sign Terms of Reference, Target US$50 Billion Trade by 2030

Economy & Trade Mar 03India and Canada have set a course to mend diplomatic ties after three years of strained relations. The prime ministers of both countries announced the launch of negotiations for the Comprehensive Economic Partnership Agreement (CEPA), advancing trade, investment, and strategic cooperation.

Tax & Accounting

India Tax Calendar March 2026: Guide to Advance Tax, Transfer Pricing, and FTC Filing

Feb 26As FY 2025-26 approaches its close, March 2026 represents a key compliance period under India’s direct tax framework. Businesses should review the March tax compliance calendar and ensure timely data reconciliation and reporting readiness.

-

India–France Tax Treaty Revised: Dividend Relief, Capital Gains Changes, and Investor Impact

Tax & Accounting Feb 25The revised India–France tax treaty changes dividend taxes, capital gains rights, and compliance rules. Key insights for French investors and India operations.

-

IGST Applicability on Expatriate Employment in India: Karnataka High Court Provides Tax Clarity

Tax & Accounting Feb 21The Karnataka High Court has clarified the GST treatment of expatriate employment in India, ruling that remuneration paid to foreign employees under a genuine employer-employee relationship is not subject to IGST under the reverse charge mechanism.

-

India's Component Warehousing Safe Harbor: A Competitive Tax Proposition for Global Manufacturers

Tax & Accounting Feb 11India’s Budget 2026-27 introduces a 2 percent safe harbor for bonded component warehousing and a five-year tax exemption for non-resident suppliers, offering transfer pricing certainty and strengthening India’s role in global manufacturing supply chains.

-

India Unveils Draft Income Tax Rules, 2026 Ahead of April 1 Rollout

Tax & Accounting Feb 09India’s tax administration has released the draft Income Tax Rules, 2026. The proposal streamlines the compliance framework, reducing it to 333 rules and 190 statutory forms. Public consultation remains open until February 22, 2026.

Legal & Regulatory

India Revises External Commercial Borrowing Framework with 2026 FEMA Amendment: Notes for Businesses

Mar 03The RBI’s 2026 ECB amendments raise borrowing limits to USD 1 billion, simplify compliance, and restructure India’s cross-border financing framework.

-

Leave India Notice (LIN) on Employment Visa: A Compliance Checklist for Expats

Legal & Regulatory Feb 25A recent judgment by the Karnataka High Court has clarified how Leave India Notices are issued to foreign workers in India, holding that immigration authorities need not separately hear the employee if compliance issues originate from the sponsoring employer.

-

What Counts as an “Industry” Under Indian Law? Supreme Court to Decide on March 17-18

Legal & Regulatory Feb 16India’s Supreme Court will revisit the definition of “industry” under the Industrial Disputes Act, 1947, a ruling that could directly influence the interpretation and implementation of the Industrial Relations Code, 2020.

-

New FEMA Guarantees Framework: From Approval-Centric Controls to a Principle-Led Regime

Legal & Regulatory Feb 16The RBI has replaced the Foreign Exchange Management (Guarantees) Regulations, 2000, with the 2026 Regulations, introducing a principle-based, eligibility-driven framework under FEMA while retaining the underlying statutory prohibition structure.

-

India's Antitrust Regulator CCI Fines Intel US$3.01 Million for Abuse of Dominant Position

Legal & Regulatory Feb 13Antitrust regulator CCI has imposed a US$3.01 million fine on Intel Corporation for an India-specific warranty policy deemed discriminatory and restrictive of parallel imports. The ruling clarifies how dominance is assessed under Indian competition law and highlights key compliance risks global companies.

Industries

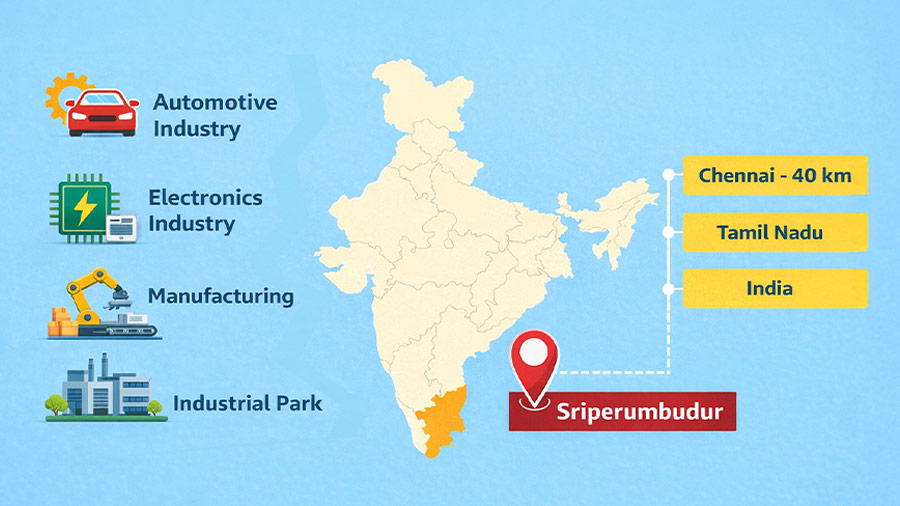

Investing in Sriperumbudur: Tamil Nadu's High-Value Manufacturing Corridor

Feb 17Sriperumbudur in Tamil Nadu is one of India’s most strategic high-value corridors, propelled by electronics production and a strong global OEM presence, including Foxconn. The region offers a scalable and de-risked platform for investment in India through 2026.

-

What Counts as an “Industry” Under Indian Law? Supreme Court to Decide on March 17-18

Industries Feb 16India’s Supreme Court will revisit the definition of “industry” under the Industrial Disputes Act, 1947, a ruling that could directly influence the interpretation and implementation of the Industrial Relations Code, 2020.

-

India’s Orange Economy: Creative Industries Outlook After Budget 2026

Industries Feb 16As of 2026, India’s orange economy is emerging as a high-growth services opportunity, spanning media, live concerts, AVGC, and creative industries, supported by policy reform.

-

India Fast-Tracks New Drug & Clinical Trial Approvals with 2026 NDCT Amendments

Industries Feb 12India’s 2026 amendments to the New Drug and Clinical Trials (NDCT) Rules, 2019, materially improve the operating environment for pharmaceutical companies, contract manufacturers, and foreign investors by compressing approval timelines and reducing pre-licensing bottlenecks.

-

India's Textile PLI Scheme: Extended Window till March 31

Industries Feb 10India has extended the application window for the Textile PLI Scheme to March 31, 2026. Businesses in the textile sector should act quickly to secure incentives for scaling production and strengthening export competitiveness.

HR & Payroll

Leave India Notice (LIN) on Employment Visa: A Compliance Checklist for Expats

Feb 25A recent judgment by the Karnataka High Court has clarified how Leave India Notices are issued to foreign workers in India, holding that immigration authorities need not separately hear the employee if compliance issues originate from the sponsoring employer.

-

IGST Applicability on Expatriate Employment in India: Karnataka High Court Provides Tax Clarity

HR & Payroll Feb 21The Karnataka High Court has clarified the GST treatment of expatriate employment in India, ruling that remuneration paid to foreign employees under a genuine employer-employee relationship is not subject to IGST under the reverse charge mechanism.

-

What Counts as an “Industry” Under Indian Law? Supreme Court to Decide on March 17-18

HR & Payroll Feb 16India’s Supreme Court will revisit the definition of “industry” under the Industrial Disputes Act, 1947, a ruling that could directly influence the interpretation and implementation of the Industrial Relations Code, 2020.

-

Uttar Pradesh Updates Shops & Establishments Law: Check Applicability, Working Hours, and Compliance

HR & Payroll Feb 11The Indian state of Uttar Pradesh has overhauled its Shops and Commercial Establishments Act, expanding statewide applicability and modernizing employer compliance. The latest updates include threshold-based coverage, digital registration, revised working hours, and stronger enforcement for businesses operating in the state.

-

Madhya Pradesh Shops & Establishments Act Amendment: Digital Compliance Reforms and Employer Implications

HR & Payroll Feb 10The Madhya Pradesh Shops & Establishment Act, Second Amendment, enacted on December 15, 2025, brings digital registration, online inspections, real-time updates, and simplified compliance for employers operating in the state.

Expert Guidance about Business in Asia

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing market entry, legal, accounting, tax, HR, technology and operational advisory to international investors.

Business Updates for All Asia Markets

Asia Briefing publishes articles, magazines, and guides on doing business in Asia. Dezan Shira & Associates has produced the publication since 1999.

Need More Guidance?

India Briefing Publications

Download magazines and guides on doing business in India.

Download Now