-

Other Briefings

- Subscribe

Private Limited vs LLP vs OPC in India: Complete Guide for Foreign Investors

Learn how to choose between Private Limited Company, LLP, or OPC when starting a business in India. Read our essential guide for foreign investors, entrepreneurs, and global companies entering India’s fast-growing market.

Why Foreign Companies Fail in India: 5 Costly Mistakes and Lessons for Future Investors

Foreign companies often fail in India due to five recurring mistakes: choosing the wrong entry structure, misjudging regulatory complexity, misreading consumer behavior, adopting poor market models, and weak talent management.

Six Registrations, One Form: India's AGILE-PRO-S Simplifies Business Registration

India Briefing provides a comprehensive guide to AGILE-PRO-S and its integration with SPICe+, explaining how India’s single-window incorporation system streamlines tax, labor, and establishment registrations for new companies.

India Eases Port Procedures as Strait of Hormuz Disruptions Force Cargo to Turn Back

India has waived certain port procedures for returned export cargo amid shipping disruptions in the Strait of Hormuz, while DP World offers alternative routing through UAE ports to maintain Gulf trade flows.

-

India’s Crude Oil Tracker 2026: Supply Diversification and Energy Security Measures

Economy & Trade Mar 12 -

Standardizing Payroll in India: Leveraging the National Floor Wage Under the New Labor Codes

Human Resources & Payroll Mar 11 -

India Relaxes FDI Rules for Neighboring Countries, Allowing Minority Investments via Automatic Route

Economy & Trade Mar 12 -

India's New FDI Rules for Land-Border Countries: 60-Day Approval, Beneficial Ownership Explained

Legal & Regulatory Mar 12 -

Business Opportunities for Italian SMEs in India Under the India–EU Free Trade Agreement

Economy & Trade Mar 12

Get free access to our subscriptions and publications

Subscribe to receive weekly India Briefing news updates, our latest doing business publications, and access to our Asia archives.

Sign Up Now

Economy & Trade

India’s Crude Oil Tracker 2026: Supply Diversification and Energy Security Measures

Mar 12With crude prices hitting US$113.57 as of March 11, 2026, is India’s energy supply secure? Learn about the March 2026 Natural Gas Control Order, increased domestic LPG production, and India’s shift to sourcing crude oil from 40 different countries.

-

India Relaxes FDI Rules for Neighboring Countries, Allowing Minority Investments via Automatic Route

Economy & Trade Mar 11India has eased Press Note 3 restrictions by allowing sub-10 percent minority investments from neighboring countries through the automatic route and introducing a 60-day fast-track approval system for manufacturing sectors.

-

Business Opportunities for Italian SMEs in India Under the India–EU Free Trade Agreement

Economy & Trade Mar 10Explore how Italian SMEs can benefit from the India–EU Free Trade Agreement through improved market access, tariff reductions, and supply chain opportunities in India.

-

India–EU FTA: Turning Market Access into an Operating Advantage for EU Businesses

Economy & Trade Mar 10The India–EU FTA opens major opportunities for EU exporters and investors through tariff cuts, services liberalization, and integrated supply chains across India.

-

Understanding Rules of Origin in the India–EU FTA: What Exporters Must Know

Economy & Trade Mar 10Rules of Origin in the India–EU FTA will shape sourcing, manufacturing, and tariff eligibility for exporters. Understand compliance, cumulation rules, and supply chain implications.

Tax & Accounting

India Tax Calendar March 2026: Guide to Advance Tax, Transfer Pricing, and FTC Filing

Feb 26As FY 2025-26 approaches its close, March 2026 represents a key compliance period under India’s direct tax framework. Businesses should review the March tax compliance calendar and ensure timely data reconciliation and reporting readiness.

-

India–France Tax Treaty Revised: Dividend Relief, Capital Gains Changes, and Investor Impact

Tax & Accounting Feb 25The revised India–France tax treaty changes dividend taxes, capital gains rights, and compliance rules. Key insights for French investors and India operations.

-

IGST Applicability on Expatriate Employment in India: Karnataka High Court Provides Tax Clarity

Tax & Accounting Feb 21The Karnataka High Court has clarified the GST treatment of expatriate employment in India, ruling that remuneration paid to foreign employees under a genuine employer-employee relationship is not subject to IGST under the reverse charge mechanism.

-

India's Component Warehousing Safe Harbor: A Competitive Tax Proposition for Global Manufacturers

Tax & Accounting Feb 11India’s Budget 2026-27 introduces a 2 percent safe harbor for bonded component warehousing and a five-year tax exemption for non-resident suppliers, offering transfer pricing certainty and strengthening India’s role in global manufacturing supply chains.

-

India Unveils Draft Income Tax Rules, 2026 Ahead of April 1 Rollout

Tax & Accounting Feb 09India’s tax administration has released the draft Income Tax Rules, 2026. The proposal streamlines the compliance framework, reducing it to 333 rules and 190 statutory forms. Public consultation remains open until February 22, 2026.

Legal & Regulatory

Standardizing Payroll in India: Leveraging the National Floor Wage Under the New Labor Codes

Mar 11India’s floor wage system under the Code on Wages, 2019, establishes a national wage benchmark that guides how minimum wages are set across states. Understanding its interaction with state-level minimum wage regulations is essential for businesses managing labor costs and compliance

-

India's New FDI Rules for Land-Border Countries: 60-Day Approval, Beneficial Ownership Explained

Legal & Regulatory Mar 11India has revised FDI rules for land border countries with clearer beneficial ownership norms and a 60-day approval process to attract investment into key manufacturing sectors.

-

India-EU FTA Product-Specific Rules of Origin: What Annex 3-A Means for Manufacturers and Supply Chains

Legal & Regulatory Mar 10Understand the India-EU free trade agreement (FTA) product-specific Rules of Origin (RoO) to determine your product's eligibility for preferential tariffs and strategically restructure your supply chain for duty-free market access.

-

India Revises External Commercial Borrowing Framework with 2026 FEMA Amendment: Notes for Businesses

Legal & Regulatory Mar 03The RBI’s 2026 ECB amendments raise borrowing limits to USD 1 billion, simplify compliance, and restructure India’s cross-border financing framework.

-

Leave India Notice (LIN) on Employment Visa: A Compliance Checklist for Expats

Legal & Regulatory Feb 25A recent judgment by the Karnataka High Court has clarified how Leave India Notices are issued to foreign workers in India, holding that immigration authorities need not separately hear the employee if compliance issues originate from the sponsoring employer.

Industries

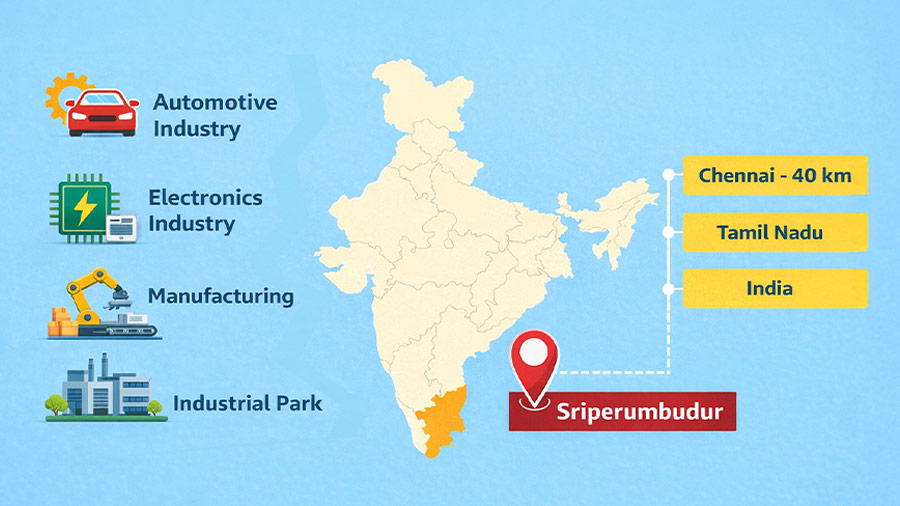

Investing in Sriperumbudur: Tamil Nadu's High-Value Manufacturing Corridor

Feb 17Sriperumbudur in Tamil Nadu is one of India’s most strategic high-value corridors, propelled by electronics production and a strong global OEM presence, including Foxconn. The region offers a scalable and de-risked platform for investment in India through 2026.

-

What Counts as an “Industry” Under Indian Law? Supreme Court to Decide on March 17-18

Industries Feb 16India’s Supreme Court will revisit the definition of “industry” under the Industrial Disputes Act, 1947, a ruling that could directly influence the interpretation and implementation of the Industrial Relations Code, 2020.

-

India’s Orange Economy: Creative Industries Outlook After Budget 2026

Industries Feb 16As of 2026, India’s orange economy is emerging as a high-growth services opportunity, spanning media, live concerts, AVGC, and creative industries, supported by policy reform.

-

India Fast-Tracks New Drug & Clinical Trial Approvals with 2026 NDCT Amendments

Industries Feb 12India’s 2026 amendments to the New Drug and Clinical Trials (NDCT) Rules, 2019, materially improve the operating environment for pharmaceutical companies, contract manufacturers, and foreign investors by compressing approval timelines and reducing pre-licensing bottlenecks.

-

India's Textile PLI Scheme: Extended Window till March 31

Industries Feb 10India has extended the application window for the Textile PLI Scheme to March 31, 2026. Businesses in the textile sector should act quickly to secure incentives for scaling production and strengthening export competitiveness.

HR & Payroll

Standardizing Payroll in India: Leveraging the National Floor Wage Under the New Labor Codes

Mar 11India’s floor wage system under the Code on Wages, 2019, establishes a national wage benchmark that guides how minimum wages are set across states. Understanding its interaction with state-level minimum wage regulations is essential for businesses managing labor costs and compliance

-

Leave India Notice (LIN) on Employment Visa: A Compliance Checklist for Expats

HR & Payroll Feb 25A recent judgment by the Karnataka High Court has clarified how Leave India Notices are issued to foreign workers in India, holding that immigration authorities need not separately hear the employee if compliance issues originate from the sponsoring employer.

-

IGST Applicability on Expatriate Employment in India: Karnataka High Court Provides Tax Clarity

HR & Payroll Feb 21The Karnataka High Court has clarified the GST treatment of expatriate employment in India, ruling that remuneration paid to foreign employees under a genuine employer-employee relationship is not subject to IGST under the reverse charge mechanism.

-

What Counts as an “Industry” Under Indian Law? Supreme Court to Decide on March 17-18

HR & Payroll Feb 16India’s Supreme Court will revisit the definition of “industry” under the Industrial Disputes Act, 1947, a ruling that could directly influence the interpretation and implementation of the Industrial Relations Code, 2020.

-

Uttar Pradesh Updates Shops & Establishments Law: Check Applicability, Working Hours, and Compliance

HR & Payroll Feb 11The Indian state of Uttar Pradesh has overhauled its Shops and Commercial Establishments Act, expanding statewide applicability and modernizing employer compliance. The latest updates include threshold-based coverage, digital registration, revised working hours, and stronger enforcement for businesses operating in the state.

Expert Guidance about Business in Asia

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing market entry, legal, accounting, tax, HR, technology and operational advisory to international investors.

Business Updates for All Asia Markets

Asia Briefing publishes articles, magazines, and guides on doing business in Asia. Dezan Shira & Associates has produced the publication since 1999.

Need More Guidance?

India Briefing Publications

Download magazines and guides on doing business in India.

Download Now