Overview of hiring employees

Hiring staff is one of the first key decisions a company will come across in India. A firm understanding of India’s laws and regulations related to human resources (HR) management is essential for foreign investors who want to establish or are already running foreign-invested entities in India.

With the objective to consolidate and reform labor laws and to facilitate the ease of doing business in India, the Government of India has enacted four labor codes, which consist of approximately 29 labor laws.

Organizations in India are reshaping compensation and benefits to prioritize employee well-being post-pandemic. HR policies like remote work, flexibility, wellness programs, and skill development are gaining traction, especially among younger talent.

Technology aids HR in adapting to evolving workplace needs. Investors must align with these trends to stay competitive. Additionally, Tier-2 cities are emerging as key talent hubs, attracting multinational firms to more cost-effective locations.

How can a company become eligible to hire employees in India?

Employing through your own legal entity

One can establish one’s own company branch or subsidiary in India and handle the logistics of hiring and other HR tasks internally. To set up a subsidiary in India, one must start by researching the regulations that apply to the sector.

Most international companies that establish a subsidiary in India choose either a private or public limited company structure. To establish one’s subsidiary and start hiring someone in India, one must have obtained the following:

- Director Identification Number (DIN);

- Digital Signature Certificate (DSC);

- Business name approved by the Registrar of Companies;

- Memorandum and Articles of Association;

- Incorporation application;

- Certificate to commence operations;

- Permanent Account Number (PAN);

- Employees’ Provident Fund Organization filing;

- Goods and Services Tax (GST) registration; and

- Medical insurance application.

One may also need to obtain special permits or other permissions depending on one’s industry or location. Companies must plan for sufficient time to make sure every requirement is in place before the recruiting process is initiated.

Leveraging an employer of record

To hire new employees in India, one can establish a company as an employer or work with an Employer of Record (EOR), also known as a professional employment organization (PEO).

An EOR will already have everything in place that is needed to start hiring new employees in India, so one can begin the hiring process immediately. Additionally, EORs are well-versed with Indian employment laws and how to structure competitive salary and benefits packages.

Passing off these HR responsibilities also means one avoids the risk of non-compliance.

Employment contract

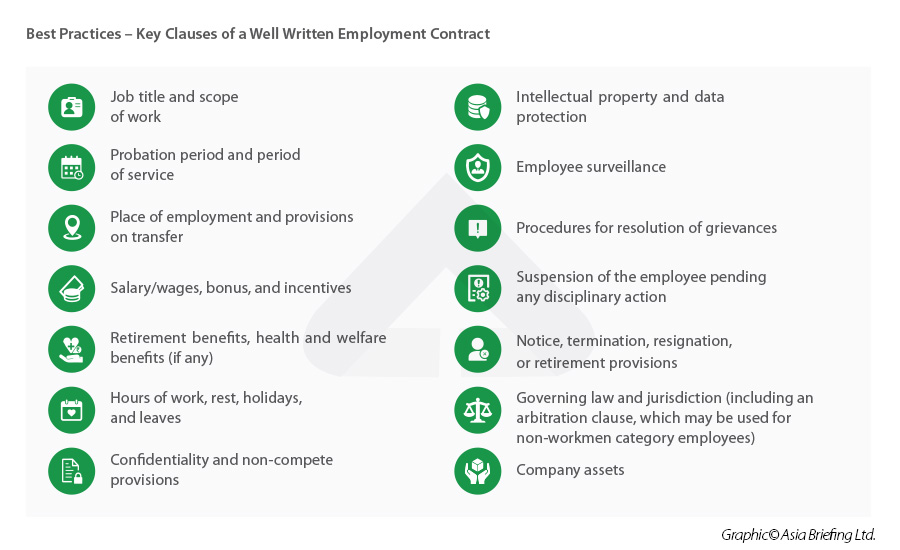

There is no provision in existing labor laws that requires an employer to provide a written statement of particulars to a newly hired employee. However, as a matter of best practice, written employment contracts are executed between the employer and the employee, or a detailed written appointment letter is issued to the employee, the terms of which are required to be duly accepted and acknowledged by the employee.

To ensure the contract is valid and complies with the Indian labor law it is advisable to draft the employment contract together with a local expert.

Key clauses of a well-written employment contract

Types of Labor Contracts

There are three types of employment contracts in India:

- Permanent (direct) contract;

- Fixed contract; and

- Temporary contract.

Private employers in India opt for either open-ended or fixed-term contracts.

- An open-ended contract continues until the employer or employee ends it. If the employer terminates such a contract, they would need to provide severance pay and comply with applicable statutory requirements, such as those related to retrenchment, upon the time of termination.

- A fixed-term contract is legally applicable for a stipulated fixed duration. Such contracts are drawn when the employee is hired to fulfill a time-bound or project task.

Zero-hours worker contracts

A further type of contract to be aware of is that which applies for workers. The distinguishing feature of these contracts is that there’s no obligation for the employer to offer a minimum number of hours of work, or for the worker to accept them. This is known as mutuality of obligation.

Workers on zero-hour contracts are still entitled to some statutory employment rights including the statutory minimum level of paid holiday and the National Minimum Wage / National Living Wage.

It’s also important to note that it’s illegal to require a worker to work exclusively for you, so you can’t include an exclusivity clause in your worker contracts.

Consultancy agreements

When it comes to working with self-employed contractors, consultants or freelancers, it’s equally important to have a written document – commonly known as a ‘consultancy agreement’ – in place to set out expectations for the working relationships.

The content of this blog is for general information only. Please don’t rely on it as legal or other professional advice as that is not what we intend. You can find more details on this in our Terms of Website Use. If you require professional advice, please get in touch.

Types of employees

Based on the contract duration and who is the legally identified employer, there are multiple categories of workers under Indian labor law.

Full-time employees

A full-time employee is one who is exclusively working for their company and is restricted from working for any other employer or performing any other vocational work.

Full-time employees enjoy benefits not typically offered to part-time, temporary, or flexible workers, such as annual leave, sick leave, and health insurance, among others. Every adult, defined as 18 years or older, can work for more than 48 hours in a week and not more than 8 hours in a day. Hence, full-time workers normally work for 40 or 48 hours a week as per company policy.

Part-time employees

Part-time employees are entitled to all the rights of regular employees, the only difference being, they receive proportionate benefits and work for fewer hours than full-time employees.

Contract workers

A contractual worker is a workman employed for contractual work through a “contractor” and not directly through an employer. A contractor is the supplier of contractual labor to the principal employer. A contract worker is employed for a specified period and for specific tasks.

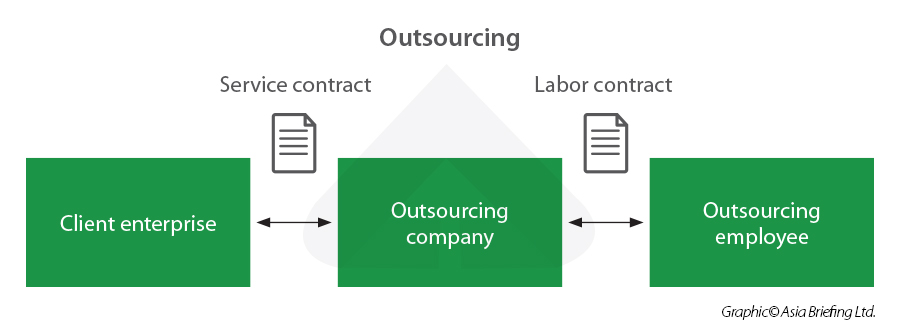

Outsourcing

Outsourcing helps businesses avoid tedious administrative processes and still match workforce needs. Under this model, the client enterprise has no direct employment relationship with the outsourcing employees.

Special characteristics:

- The outsourcing task usually requires a high level of specialization, confidentiality, or defined scope;

- The outsourcing agreement usually does not refer to specific employees or performance criteria but rather defines the work that needs to be done;

- The outsourcing tasks usually need to be processed with special software licensed by the outsourcing company, but the client enterprise usually does not need to pay for the software license or the development work; and

- The outsourcing company usually retains a high level of autonomy to direct whichever resources it feels are best for each project.

Hiring foreign workers

Skilled and qualified foreign nationals who want to work for a company in India can apply for an Employment Visa (‘E’ Visa), if it matches any of the purposes or job descriptions as outlined by the Ministry of Home Affairs. There are also provisions for social security and withdrawal of contributions for international workers. Tax liability is computed based on tax residency.

Tax Compliance

Obligations of the employee

- PAN registration: Foreign nationals who come to India for the purpose of employment are required to apply in the prescribed form for allotment of a Permanent Account Number (PAN). The PAN is the individual’s tax registration number in India.

- Advance tax: Any person in India whose estimated tax liability (net of taxes deducted at source) is more than INR 10,000 in a financial year must pay income tax in advance. Normally, for tax liability less than INR 10,000, the income tax for a financial year is paid in the assessment year (AY). Resident senior citizens who do not have any income from a business or profession are not liable to pay advance tax.

- Investment declaration to the employer: A mandatory declaration is required to be provided by the salaried employee to the employer in Form 12BB to claim tax benefits or rebates on investments and expenses.

- Filing annual tax return: As per India’s domestic tax law, every individual is required to file a tax return for the respective financial year (FY) with the Indian tax authorities by July 31 of the following financial year (assessment year or AY) if they meet specified conditions.

- Income tax clearance: All individuals who are not domiciled in India / not a resident of India; who have come to India in connection with business, profession, or employment; and who have derived income from any source in India – are required to obtain an Income Tax Clearance Certificate from Indian tax authorities prior to exiting India.

Obligation for companies

India’s domestic tax law requires any person or establishment responsible for making salary payments to obtain a Tax Deduction Account Number (TAN) and withhold tax at appropriate rates on the salary remunerated to the employees.

Wages

Both the central and state governments have control over fixing the minimum wages of employment. Wage rates of employment differ across occupations, skills, sectors, and regions. Given the extent of difference between various kinds of employable work, there is no set wage rate that can be set for each specific work across the country.

Negotiating compensation packages is an involved process in India due to all the allowances many employees receive on top of their basic pay. These allowances can equate to so much that an employee’s basic salary constitutes 50 percent of their total compensation. These allowances may include:

- Performance-based bonuses;

- Children's education allowance;

- Children's hostel allowance;

- House rent allowance (HRA);

- Vehicle allowance;

- Telephone or mobile phone Allowance;

- Leave travel allowance or concession (LTA/LTC); and

- Special allowance.

Work hours and overtime pay

For most industries, employees should not work more than 8 hours per day and not more than 48 hours per week in total.

If an employee has fixed minimum wages for a particular period of time, the employee should receive overtime pay for work done beyond the specified period. Like the regulations for work hours, regulations for overtime pay may also vary depending on the industry.

Social security system

India’s social security system is currently composed of a number of schemes and programs spread throughout a variety of laws and regulations. India’s social security schemes cover the following types of social insurance:

- Employee provident fund, health insurance, and medical benefit under respective schemes;

- Disability benefit;

- Maternity benefit;

- Adoption and surrogacy benefits;

- WFH arrangement;

- Mandatory crèche facilities; and,

- Gratuity.

Annual bonuses

Companies with at least 20 employees or factories with at least 10 employees must pay each eligible employee a bonus. The act states that the employer must pay the bonus within the financial year.

The amount must be at least 8.33 percent but not exceeding 20 percent of the salary or wage earned by the employee or INR 100, whichever is higher. The compensation package must include this bonus.

The company does not have to pay its employees a bonus for the first five years if it has not made a profit for that financial year. However, after the first five years, the company will have to pay the bonus whether it has profited that year or not.

Payroll processing

Payroll processing is broadly similar to the systems used in Western countries: businesses calculate the employees’ wages and bonuses and withhold taxes and deductions – like personal income taxes and social security payments – from employees’ salary. Many companies also offer benefit plans like health insurance, which includes deductions of premiums from the employee’s salary (according to employee customization), adding another layer of activity for payroll processing.

| Statutory Body | Purpose | Form Name | Submission | Submission Due Date | Submission Format |

|---|---|---|---|---|---|

| Employees’ Provident Fund Organization | Social security contribution | Statement of contribution made | Monthly | 15th of the month following the end of month | Electronic |

| Income Tax Department | Deposit of withholding tax | TDS Challan | Monthly | 7th of the following month* | Electronic |

| Income Tax Department | Withholding tax return | 24Q | Quarterly | 31st of the month following the end of the quarter** | Electronic |

| State Revenue Department | Professional tax return (if applicable)** | Professional tax return | Monthly / Quarterly / Annually | Varies by state | Electronic |

| Notes: * For the month of March, the due date to deposit TDS is April 30. **For the fourth quarter, the due date to file Withholding Tax Return is May 31. |

|||||

HR Policies in India: 10 Best Practices for Employers

Here, we briefly discuss 10 key areas that foreign employers should pay attention to when handling staff in India.

1. Employment Contracts

India does not mandate a written employment contract for local employees. However, it is advisable for companies to use contracts to limit risk and define the terms and conditions of employment.

Indian employment laws are diverse and form a complex framework that employers must navigate carefully when constructing contracts. Apart from labor laws, there are industrial laws, The Companies Act, and the Contract Act of 1872 that govern employment conditions in India.

Both the state and federal governments create and enforce laws pertaining to employment, which can complicate compliance for those who are unfamiliar with the country. HR managers should keep themselves updated and develop employment contracts in accordance with these to prevent future legal complications.

2. Wages

Employers should seek to periodically audit their wage structure to ensure it remains competitive within the local labor market. However, it is perhaps more important to ensure wages are compliant with prevailing laws.

Under the Code on Wages Bill, 2019:

All employers in the organized sector must provide ‘the basic cost of living’ to employee categories specified within the act. The code further enables the federal government to fix the minimum statutory wage for millions of workers and orders the timely disbursement of wages to employees.

Code on Social Security, 2020 mandates non-discrimination for payment of wages to men and women.

Companies should ensure that employment contracts consider this while defining the terms and conditions for the remuneration for employees.

3. Termination of employment

Employees in India may only be terminated as per the terms and conditions within their employment contract.

However, companies should note that all employers must adhere to federal and state labor laws when laying off or terminating workers – the conditions drafted in company contracts cannot supersede these legal statutes.

Finally, termination without notice is prohibited in India. Termination periods vary by function and length of employment.

4. Maternity and paternity leave

The Maternity Benefits (Amendment) Act, 2017 applies to all shops and any establishments that employ over 10 workers. Under the Act, 26 weeks of paid leave is available for women for the first two children and 12 weeks for every subsequent child. Companies employing more than 50 people must also provide crèche services.

The Maternity Benefit Act also secures 12 weeks of maternity leave for mothers adopting a child below the age of three months as well as to commissioning mothers (biological mothers) who opt for surrogacy.

The Paternity Benefits Bill, 2017 is set to be up for discussion in the next parliamentary session. However, a significant number of organizations, especially foreign companies like Microsoft and IKEA, already include a mutually decided paternity leave clause within their company policy.

As of now, there is no law mandating paternity leave in the private sector. According to recent surveys, only 14 percent of Indian companies have policies related to paternity leave. Paternity leave in India for Private companies is governed by the company's own policies and regulations.

5. Prevention of sexual harassment in the workplace

The Indian government has brought the safety of women in the workplace to the forefront of its law-making.

An Internal Complaints Committee must be set up by all organizations with more than 10 employees in accordance with the norms laid out in the Sexual Harassment of Women at Workplace (Prevention, Prohibition, and Redressal) Act, 2013. All complaints should be actively pursued, evidenced, and redressed immediately.

To guarantee employee safety, companies must draft appropriate HR policies within the firm and ensure they are clearly communicated to all personnel.

HR personnel should organize workshops or sensitization programs and encourage communication to promote an organizational culture that provides for a fair and safe working environment for all its employees.

6. Public holidays and work weeks

India observes three national holidays –

- Republic Day (January 26);

- Independence Day (August 15); and

- Gandhi Jayanti (October 2).

On these days, all institutions, whether public or private, must remain closed.

Government approval is necessary for any organization to function on these days. Only certain establishments, such as factories and industries where the work process is considered to be continuous, including hospitals, and travel agencies, are allowed to operate over 24 hours across 365 days. However, establishments that operate on these days are subject to providing additional wages for staff working on those days.

Additionally, firms must inform the annual list of holidays and weekly offs available to employees each year. The number of leaves and categories of leave must ideally be explained in the employee contract.

Many laws in India, such as the Occupational Safety, Health, and Working Conditions Code Bill, 2020 also provide for the maximum number of work hours and the amount of overtime wages to be paid to labor employed.

7. Restrictive clauses in employment contracts

Employers should note that including restrictive clauses in a contract might not be enforceable through the Indian courts. The Contract Act, 1872, necessitates the fundamental right of all citizens to carry on any profession, trade, or business.

Non-compete, non-disclosure, non-solicitation, and ‘garden leave’ clauses are examples of restrictive clauses that can only be imposed by the courts if plausible grounds – with respect to time period and nature of activities involved – are provided.

The best way to ensure enforceability is to restrict the scope of the clauses as much as possible within these dimensions. However, this does not guarantee legal protection to employers.

8. Gratuity and Provident Fund

Code on Social Security, 2020 provides the guidelines for gratuity owed to an employee.

The number of years of service of the employee is the criteria for deciding the amount of gratuity owed, and this payment by the company is obligatory by law.

The minimum amount (more may be approved) must be given to an employee in case of the following circumstances:

- Retirement;

- Resignation;

- Disablement due to accident or illness; or,

- Death of the employee (gratuity paid to employee’s nominees).

However, if an employee is dismissed for proven criminal or moral reasons, no gratuity is owed to them.

Similarly, the Employees Provident Fund Organization of India (EPFO) oversees and regulates the Employee’s Provident Fund (EPF).

Under this scheme, the employer and employee contribute an equal amount to the fund every month, which is accessible to the employee at certain points in their career.

The EPF scheme is mandatory for a salary below INR 15,000 (US$183.30) and voluntary thereafter.

9. Impact of digitalization

Workplaces are becoming increasingly virtual. Firms and employees both require real-time employee information to improve critical efficiencies and maintain core compliances within the organization.

The scope of work for HR departments has expanded to include the use of digital technology, through apps and in-house databases, especially in the service and consultancy sectors. This includes the use of online platforms and applications for processes such as recruitment, learning and development, and even day-to-day administration.

Business leaders should consider increasingly affordable integrated software solutions that automate aspects of HR administration and payroll. This often allows back offices to focus on providing value-added services, allowing front offices to invest more in growth, services, and innovation.

10. Adaptive work culture

Job seekers in India are moving away from traditional work modes – such as a ‘9 to 5’ time pattern – to a more holistic view of career development.

Organizations are also gradually incorporating the idea of work-life balance into their corporate culture.

Responsive and adaptive HR departments are key to cultivating these organizational values and fostering a balance between employee satisfaction and productivity.

Working conditions in Indian multinational companies are also changing to incorporate flexi-time or work-from-home options into employment contracts to boost employee retention and loyalty.

FAQ:HR Automation & Technology Trends in India

What is Human Resource (HR) automation?

HR Automation is a process of using software to digitize and automate repetitive and time-consuming tasks, including employee onboarding, payroll, timekeeping, and benefits administration, to simplify HR processes. Cloud-based HR SAAS platforms have transformed the HR function and played a pivotal role in bypassing the time and effort involved in maintaining physical paperwork in everyday HR processes.

It would be fair to state that business is bound to take a hit If HR professionals in an organization spend more time on administrative work than utilizing their valuable skills in other consequential areas such as employee engagement, employee grievance redressal, workforce forecasting, talent acquisition, and updating HR policy as per ongoing regulatory changes, amongst others.

However, transitioning from manual HR systems to HR automation requires a certain level of expertise with the technology that is being integrated into organizational processes. The benefits of HR automation far outweigh the time, energy, and capital the organization will invest in the process.

Why should businesses invest in HR automation?

HR Automation directly results in enhancing the productivity of an organization’s HR Department. This is attained by maximizing efficiencies across several HR-related processes to reduce the administrative burden and minimize compliance costs. We have listed some key benefits of HR Automation below:

- Enhanced efficiency and productivity

HR largely depends on document-driven processes, which, when done manually, can be time-consuming, repetitive, and extremely inefficient. Automation of human resource functions can improve the efficiency and productivity of an organization by automating such tedious tasks.

- Boosts cost savings

Automating manual HR operations can help an organization save a substantial amount of capital in the long run. As information is stored online, the money that would previously be spent on paperwork and storage space would be eliminated.

- Simplifies HR processes

HR tech can greatly improve the employee experience in an organization. By automating all essential HR functions, the employees will be able to get their work done much faster. Since everything is automated from a single system, employees can find any information they need online.

- Reduced data errors

As an HR professional, one must deal with tons of employee data on a daily basis. Errors are sometimes inevitable when the data is managed manually. These errors can affect an organization on different levels, reducing the overall efficiency of its operations.

- Actionable insights

HR automation enables organizations to track, collect, and analyze data of all kinds. This allows them to spot patterns and create reports on their findings. They can then use these insights to improve processes, correct any failures, and do more of what’s working across the business.

- Improved communication and collaboration

HR automation gives a clear overview of all the processes and stages involved. This helps everyone understand each other’s responsibilities, thereby improving overall communication and teamwork.

What manual processes can be automated in HR?

There is a broad spectrum of HR processes that can be automated to save time and boost productivity in an organization. Some of them are:

- Talent Acquisition

Recruiting is integral to the success of any organization, as it ensures one brings in the right talent and leadership for each available position. Many recruitment processes, like posting job ads and screening CVs — can be automated easily to save the organization considerable time and energy throughout the hiring process.

- Employee Onboarding

While employee onboarding is a crucial process of the HR function, it’s traditionally a time-consuming and paper-reliant process. Automation, however, allows HR teams to offer a more standardized experience for every hire since it streamlines communication, improves efficiency, and eliminates mistakes that are characteristic of manual data entry.

- Learning & Development

Besides onboarding, training employees is critical to their success in achieving their individual goals, and the best way to approach employee training these days is through conversational technology-based training sessions. Not only does it allow HR departments to digitize their training delivery, but it also enables them to track the progress of individuals through data-driven dashboards.

- Employee Exit Management

Automation can also simplify the process of managing employee exits from the organization through digitized files that will dissolve the employee’s payroll and benefits package and follow retention schedules required to stay compliant.

- Leave Requests Management

Automation helps in syncing the employee information with payroll and human resources which helps in managing the workflow for any leave requests.

- Expense Claims Management

With HR automation, all mandatory fields and attachments for expense claims are easily created, leading to simplified expense-claiming processes and functions and easier approvals from various departments for expenses.

- Payroll Management

The advantages of automated payroll are manifold since automation can complete all types of payment functions — salaried and hourly wages, overtime, double-time, commissions, bonuses, raises, and more. Automating payroll simplifies tax filing as well, as this method maintains compliance with all relevant tax laws.

Is there a sustainable market for HR Technology in India?

The Indian HR Tech market is primarily being driven by the widespread adoption of contactless hiring solutions in organizations. The overall market size of HR technology in India was around 1.1 billion dollars in 2021.

Various technological advancements, such as the integration of artificial intelligence (AI), big data, cloud computing, and augmented reality (AR) solutions for remote hiring and the management of employees, provide the thrust to market growth.

Other factors, including rapid digitization, the adoption of work-from-home, and hybrid working models, are projected to have a positive impact on the HR Technology market growth.

What are the top HR tech trends in India?

- A permanent switch to hybrid and remote working teams

Hybrid work schedules, meaning a mix of work from home/anywhere and work from the office, are likely becoming the norm. Applications, such as employee self-service (ESS) portals, are becoming more important than ever. This evolution of working models will also have a greater reliance on cloud-based systems for day-to-day administration work. Remote candidate screening and onboarding will also become a routine part of the job.

- HR to Play a vital role in cybersecurity

With increased digitization and remote work, the threat of cybersecurity is ubiquitous. Around 55 percent of people working remotely have experienced a cybersecurity issue over the past year, with phishing and malware being the most common areas of concern. HR professionals working remotely, who are handling confidential employee data, are at a greater risk of hacking.

It is imperative that HR teams follow strict security protocols when working from home.

- AI’s role in recruitment

For HR professionals, one of the main applications of AI is in candidate screening. Application tracking system (ATS) platforms use AI to screen resumes, and automated chatbots can handle routine questions from applicants.

- Augmented Analytics in HR

HR professionals are increasingly resorting to augmented analytics trends to deal with HR data. HR analytics provides data-driven insights on workforce analytics and talent analytics to enhance business performance and make strategic business decisions based on these metrics.

- Inclusive and accessible work culture

Technology enables the organization to provide a more inclusive workplace. Accessibility driven tools provide opportunities for businesses to focus on larger markets and help enhance the employee work experience. These hands-free features provide users with mobility challenges and an easier option to access technology. By eliminating barriers in technology, organizations could render an all-inclusive employee experience across all their products and solutions.

- Freelance economy

Associated with the ongoing shift to the gig economy, freelance staff work for an organization but with relative mobility, independence, and away from the nine-to-five work-hour systems. This requires technology aided solutions like round-the-clock accessibility where performance is assessed typically on outcomes and linked to project management deadlines.

- Employee wellness

Employee wellness is as essential as employee performance for high productivity. HR leaders are increasingly focusing on employee wellness, health, and education to facilitate high engagement, quality, and productivity. This is particularly relevant in the post-Covid era, where employees have had to contend with multiple uncertainties and challenges, such as communication gaps, lack of motivation, training, and more.