Businesses can consider setting up or doing business with entities in India's Special Economic Zones to take advantage of favorable tax incentives, simplified customs procedures, and a conducive environment for manufacturing and trade.

[promote-webinar url="https://www.dezshira.com/events/details/navigating-global-mobility-in-2025-visa-frro-taxation-essentials-for-expatriates-in-india-10200.html"]

Special economic zones (SEZs) in India are areas that offer incentives to resident businesses. SEZs typically offer competitive infrastructure, duty free exports, tax incentives, and other measures designed to make it easier to conduct business. Accordingly, SEZs in India are a popular investment destination for many multinationals, particularly exporters.

Currently, India has 276 operational SEZs with total employment of 3.19 million people as of March 31, 2024. Goods exports from Indian SEZs reached US$143.34 billion till January 31, 2025.

In December 2022, it was reported that the Kandla SEZ in Gujarat alone accounted for US$38 billion in export value. According to a Statista report, investments into these SEZs grew to INR 656 billion (US$7.87 billion).

While India’s SEZs are similar to those found in other parts of Asia, business leaders that are considering setting up in a SEZ should seek to understand how SEZs work in India. Each SEZ is unique.

Foreign companies are advised to conduct market entry studies that compare sites, resources, tax incentives, and costs before making ground site visits.

A designated duty-free enclave is considered as a territory outside the customs jurisdiction of India for authorized operations within the Special Economic Zone (SEZ). No import license is necessary, and both manufacturing and service activities are permitted. Units within the SEZ must demonstrate Positive Net Foreign Exchange over a cumulative period of five years from the start of production. Domestic sales are subject to full customs duty and adhere to the current import policy. SEZ units have the liberty to engage in subcontracting. Routine inspections of export/import cargo by customs authorities are not required. SEZ Developers/Co-Developers and Units are entitled to direct and indirect tax benefits as stipulated in the SEZs Act of 2005.

Key amendments to SEZ rules to facilitate semiconductor manufacturing in India

On June 9, 2025, India announced a series of regulatory amendments aimed at promoting SEZs focused on semiconductor and electronic component manufacturing. These changes, introduced under the SEZ Rules, 2006, are expected to reduce entry barriers, enhance operational flexibility, and expand market access for high-tech manufacturing units.

One of the major revisions is the amendment to Rule 5 of SEZ Rules, 2006, which reduces the minimum land requirement for SEZs dedicated exclusively to semiconductors or electronic components from 50 hectares to 10 hectares. This relaxation is intended to make it easier for investors to establish such facilities.

Additionally, Rule 18 has been amended to allow these SEZ units to sell their products in the domestic market, subject to payment of applicable duties. This marks a departure from the traditional export-only model for the manufacturers.

Further, an amendment to Rule 7 empowers the SEZ Board of Approval to waive the requirement for land to be encumbrance-free in specific cases. This provision applies when the land is mortgaged or leased to central or state governments or their authorized agencies, offering greater flexibility in land acquisition and development.

Approval granted for two new high-tech SEZs

Following the notification of these amendments, the SEZ Board of Approval sanctioned two critical proposals:

- Micron Semiconductor Technology India will set up an SEZ in Sanand, Gujarat, with an estimated investment of INR 130 billion (US$1.5 billion).

- Hubballi Durable Goods Cluster Private Ltd (part of the Aequs Group) received approval to establish an SEZ in Dharwad, Karnataka, involving an investment of INR 1 billion (US$11.61 million).

India’s Union Ministry of Commerce and Industry stated that these regulatory changes are designed to support investments in sectors that are not only capital-intensive but also dependent on imports and characterized by long gestation periods.

The development of SEZs in India

The Indian government had long used export processing zones (EPZs) to promote exports. In fact, Asia’s first EPZ was established in 1965 at Kandla, Gujarat state. While these EPZs had a similar structure to SEZs, the government began to establish SEZs in 2000 under the Foreign Trade Policy. This approach aimed to address issues arising from numerous regulatory controls, inadequate infrastructure, an unreliable fiscal system, and to allure higher foreign investments from international businesses and MNCs to India.

Notable SEZs in India

The Special Economic Zone Act, 2005 amended India's SEZ policy. Many EPZs have converted to SEZs, with notable zones in Noida (Uttar Pradesh state), Falta (West Bengal state), Visakhapatnam (Andhra Pradesh state), Chennai (Tamil Nadu state), Cochin (Kerala state), Santa Cruz (Maharashtra state), Indore (Madhya Pradesh), as well as Kandla and Surat (Gujarat).

Since the Act’s promulgation, the Indian government has also accepted proposals for additional, far smaller SEZs, which must be proposed by developers to the Indian Board of Approval. The SEZ Rules, 2006 lay down the complete procedure to develop a proposed SEZ or establish a unit in an SEZ.

Consequently, the SEZ category encompasses various multiple zone types, such as free trade zones (FTZs), EPZs, industrial estates (IEs), free ports, free trade warehousing zones (FTWZz), and urban enterprise zones, among others.

Incentives for setting up in an Indian SEZ

Some incentives for setting up a sourcing or manufacturing platform within an Indian SEZ include:

- Duty free import and domestic procurement of goods for the development, operation, and maintenance of your company/SEZ unit.

- 100 percent income tax exemption on export income for SEZ units under Section 10AA of the Income Tax Act for first five years, 50 percent for the next five years thereafter and 50 percent of the ploughed back export profit for the next five years. (Sunset clause for units will become effective from April 1, 2020.)

- Income tax exemption on income derived from the business of development of the SEZ in a block of 10 years in 15 years under Section 80-IAB of the Income Tax Act. (Sunset clause for developers has become effective from April 1, 2017.)

- Exemption from customs/excise duties for development of SEZs for authorized operations approved by the BoA (Board of Approval, which is the highest decision-making body for SEZs).

- Exemption from the Goods and Service Tax (GST) and levies imposed by the state government (supplies to SEZs are zero rated under the IGST Act, 2017, meaning they are not taxed).

- Minimum Alternate Tax (MAT) must be paid by SEZ units. In September 2019, MAT was reduced to 15 percent from 18.5 percent.

- Dividend Distribution Tax abolished in February 2020.

- Single window clearances for all state and federal government approvals.

- Exemption in electricity duty and tax on sale of electricity by certain states in India.

- Presence of customs officer in the SEZs to facilitate and expedite the trade processes.

- Provision of land in some states to SEZ developers at concessional rates to promote industries in accordance with the state’s prevailing Industrial Policy.

After making a shortlist of SEZs for further examination, investors may find that specific SEZs offer other advantages that complement their business plans in India.

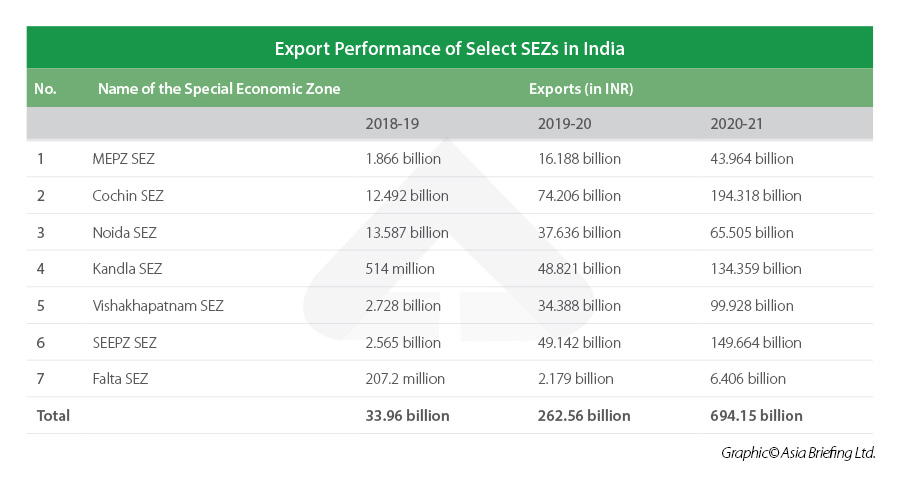

As per data from the Ministry of Commerce and Industry, from 2018-19 to 2020-21, 1096 units were registered in special economic zones in India. Exports by units in select SEZs are shown below. According to the Ministry of Commerce and Industry:

According to the Ministry of Commerce and Industry:

- SEZ exports increased from INR 228.40 billion (US$3.07 billion) in 2005-06 to INR 7595.24 billion (US$102.24 billion) in 2020-21.

- Investment in SEZs increased from INR 40.355 billion (US$0.54 billion) in 2005-06 to INR 6174.99 billion (US$83.12 billion) (cumulative basis) by 2020-21.

- Operations in SEZ units provided jobs to 134,704 persons in 2005-06 – which increased to 2,358,136 persons (cumulative basis) by 2020-21.

Choosing an SEZ location

There are many SEZs for your company to choose from – a list of which can be obtained from the Department of Commerce’s website – and so deciding on which is best for you can often be a difficult and stress-inducing process.

For companies directly sourcing from or manufacturing in India, the site should be well placed to acquire the raw materials needed for production, while at the same time being in an area suited for export.

Special Economic Zones and Warehousing Clusters in Delhi NCR

The Delhi National Capital Region (NCR) hosts about 14 SEZs, which are primarily located in satellite cities like Gurugram (formerly Gurgaon, Haryana state) and Noida. Read more here.

Special Economic Zones and Warehousing Clusters in Mumbai

The Mumbai area hosts at least seven SEZs across Mumbai and nearby cities like Navi Mumbai, and Thane. Read more here.

Special Economic Zones and Warehousing Clusters in Bengaluru

The Bengaluru (formerly Bangalore) area hosts at least 18 SEZ, which are mostly located on the city’s outskirts. Read more here.

Meanwhile, Tamil Nadu has the highest number of operational SEZs (40), followed by Karnataka (31), Maharashtra (30), and Uttar Pradesh (14).

List of operational SEZs in Gujarat

- Dahej SEZ Limited;

- Gujarat Industrial Development Corporation;

- Reliance Jamnagar Infrastructure Limited;

- Kandla SEZ;

- Surat Apparel Park;

- Surat Special Economic Zone; and

- Zydus Infrastructure Private Limited.

List of operational SEZs in Karnataka

- Biocon Limited;

- Cessna Business Park Pvt. Ltd;

- GV Techparks Pvt. Ltd.;

- Karnataka Industrial Area Development Board (KIADB);

- Manyata Embassy Business Park; and

- RMZ Ecoworld Infrastructure Pvt. Ltd.

List of operational SEZs in Maharashtra

- Infosys Technologies Limited;

- Maharashtra Industrial Development Corporation Limited (MIDC);

- SEEPZ Special Economic Zone;

- Serum Bio-pharma Park;

- Syntel International Private Limited; and

- Wokhardt Infrastructure Development Limited.

List of operational SEZs in Tamil Nadu

- Coimbatore Hitech Infrastructure Pvt. Ltd.;

- Electronics Corporation of Tamil Nadu (ELCOT);

- Mahindra World City Developers Limited;

- MEPZ Special Economic Zone;

- Shriram Properties and Infrastructure Private Limited; and

- Tata Consultancy Services Limited.

List of operational SEZs in Uttar Pradesh

- Noida Special Economic Zone (NSEZ)

- Moradabad SEZ

- Moser Bear India Ltd.

- Ansal IT City and Parks Limited

- HCL Technologies Ltd

- NIIT Technologies Limited SEZ

- WIPRO Limited

- Tata Consultancy Services Limited

Developing an SEZ in India

Developers can apply to the Indian Board of Approval to establish an SEZ where one currently doesn’t exist.

Companies, co-operative societies, individuals, and partnership firms are all able to file an application, submitting the Form-A that is available on the commerce department's website dedicated to Special Economic Zones.

The required information for the form ranges from basic details, such as the name, address, and personal information of the applicant, to more specific details of the proposal, such as the type of land it will be set up on and its means of financing.

The amount of land that the proposal requires will determine what type of SEZ it will be. Some of the different types are:

- Multi sector SEZ (requiring a minimum of 1000 hectares of land);

- *Sector specific SEZ (requiring a minimum of 50 hectares);

- Free Trade and Warehousing Zone (FTWZ) (requiring a minimum of 40 hectares); and

- IT/ITeS/handicrafts/bio-technology/non-conventional energy/gems and jewelry SEZ (requiring a minimum of 10 hectares).

*Under the sector specific SEZ, land requirement can be relaxed in certain cases, such as for IT/ITES, biotech, or health (other than hospitals) SEZs, where no minimum land area is required.

Any proposal will be first considered by the respective state government where the SEZ is to be located, before it receives formal backing from the Board of Approval.

Incentives and facilities available to developers include:

- Exemption from customs/excise duties for development of SEZs for authorized operations approved by the BOA.

- Income Tax exemption on income derived from the business of development of the SEZ in a block of 10 years in 15 years under Section 80-IAB of the Income Tax Act. (Sunset Clause for Developers has become effective from April 1, 2017).

(The article was originally published on October 23, 2014 and was last updated on June 13, 2025.)